Benefits

Personal Accident Insurance covers the following:

Accidental Death

Covers loss of life due to accident

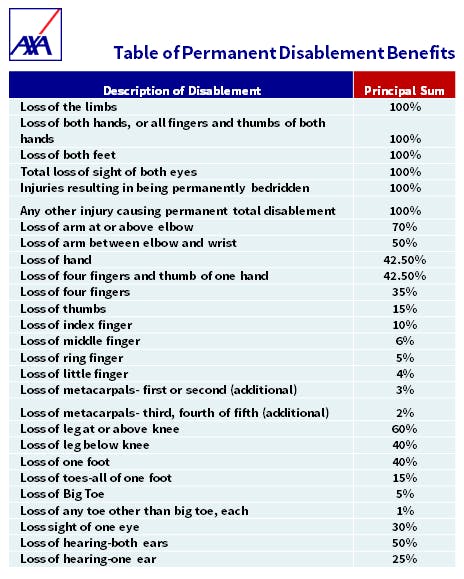

Permanent Disablement

Covers accidental bodily injury which result to permanent disablement based on the table of permanent disablement below:

General Conditions

- Any person can register up to two (2) cards at a given time except for the MBTC Elite PA cards. Only one (1) card can be registered for MBTC Elite. Any card issued in excess shall be considered null and void. In an unforeseen event, the Company shall not be liable for more than the applicable amount for any person per event.

- A written notice shall be given to the Company without unnecessary delay within 30 days in case of death from date of accident/injury.

- Any person who is 18 to 70 years old during the policy period is eligible to register.

- In the event of claim, all certificates, information and evidences required by the Company must be furnished at the expense of the Insured or his legal representatives, and shall be in such form and of such nature as the Company may prescribe. The Company shall, in case of death of the Insured, be entitled to have a post mortem examination at its own expense.

- The Insured must give immediate notice in writing to the Company of any change in address, profession or occupation and the effecting of other insurances.

- A written notice of claim given by or in behalf of the Insured or beneficiary to the Company or to any authorized representative of the Company, with information sufficient to the identity of the Insured shall be deemed to the notice of the Company.

- Indemnity under this insurance is payable to the Beneficiary/ies indicated upon activation. In case of death or in the absence of a named beneficiary/ies, the Insured shall be deemed to have named the following as his/her beneficiary/ies in the order indicated and the proceeds under this policy shall be paid accordingly:

- No assignment of the benefits of this policy shall be binding upon the activation of coverage via the link sent to the Insured’s email. The Company does not assume any responsibility for the validity of the assignment. No change of beneficiary under this Policy shall bind the Company unless consent thereto is formally endorsed hereon by the Company.

- This policy constitutes the entire insurance contract. Any rider, clause, warranty or endorsement purporting to be part of the contract of insurance and is pasted or attached to this policy is not binding to the Insured.

- Completed claim forms and written proof of loss must be furnished to the Company within ninety (90) days after the death of the Insured. Failure to furnish such proof within the time required shall not invalidate nor reduce any claim. If it was not reasonably possible to give proof within such time, the same must be given as soon as it is reasonably possible.

- The amount of loss for which the Company may be liable under this Policy shall be paid within thirty (30) days after proof of loss is received by the Company. Ascertainment is made either by agreement between the Insured and the Company or by arbitration; but if such ascertainment has not been made within sixty (60) days after such receipt by the Company of the proof of loss, then the loss or damage shall be paid within ninety (90) days after such receipt.

- If a claim made was rejected and an action or suit be not commenced either in the Insurance Commission or any court of competent jurisdiction within twelve (12) months from receipt of notice of such rejection or in case of arbitration taking place as provided herein. Twelve (12) months after due notice of the award made by the arbitrator or arbitrators or umpire, the claim shall be, for all purposes, deemed to have been abandoned and shall not thereafter be recoverable here under.

- In the event of claim, the member’s MBTC account must be active (only applicable for the Metropolitan Bank and Trust Company PA campaign).

Personal Accident Policy

Click here for a copy of the policy.

How to Make a Claim

1. Download and fill out the Personal Accident claim form.

2. Submit the claim form along with the complete documentary requirements online to customer.service@axa.com.ph or to the nearest AXA branch.

3. Wait for confirmation if your request has been approved.

4. Receive the payout via you preferred channel.

Claim Requirements

Accidental Death Claim

a) Attending Physician's Statement or Medical Certificate (original or certified true copy)

b) Police investigation Report or Statement of Witness/es (original or certified true copy)

c) Birth Certificate (original or certified true copy)

d) Death Certificate with Post Mortem Examination (original or certified true copy)

e) Autopsy Report - if available (original or certified true copy)

f) Marriage Contract (original or certified true copy)

g) Burial & Funeral Services Contract (Photocopy only)

h) Official Receipts for the Burial & Funeral Services (original only) - if there is coverage and is claiming under Accidental Burial Expense coverage

i) Certificate of Employment (for Group Personal Accident Insurance - original or certified true copy)

j) Certificate of Bona-fide Student (for Student Personal Accident Insurance - original or certified true copy)

k) Official Receipts for Medical Expenses (original only)

l) Hospital Records (photocopy only) (if available)

Permanent Disablement

a) Attending Physician's Statement or Medical Certificate (original or certified true copy)

b) Police Investigation Report or Statement of Witness/es (original or certified true) Police Investigation Report or

c) Statement of Witness/es (original or certified true copy)

d) Official Receipts for Medical Expenses (original only)

e) Picture of disabled body part (for Disablement Claim only)

Hospital Records (photocopy only) (if available)