TO OFFER YOU A BETTER EXPERIENCE, THIS SITE USES COOKIES, INCLUDING THOSE OF THIRD PARTIES. TO FIND OUT MORE, CONSULT THE PRIVACY POLICY

AXA Amnesty Program for In-force customers affected by Typhoon Karding

CUSTOMER FAQs (September 25 to November 25, 2022)

What is the amnesty program about?

a.The AXA amnesty program is the extension of the premium due grace period of selected in-force customers who are most affected by the devastation brought about by Typhoon Karding. In support of these customers, we are giving them 90 days from due date to pay their premiums vs. the normal 31-day grace period. This is in the hopes of helping out our customers who will have a hard time paying for their premiums because of the calamity

Who are covered by this program?

a.In-force customers residing in areas declared under state of calamity due to Typhoon Karding are covered by the amnesty program:

i. Policies with an address in the following areas:

- Quezon Province - Polillo, Patnanungan, Panukulan, Jomalig, Burdeus, and General Nakar

- Aurora Province - Dingalan

- Nueva Ecija Province - Entire Nueva Ecija

- Bulacan - San Miguel

- Pampanga - Macabebe

- Tarlac - Concepcion

ii. and with premium due dates from September 25, 2022 to November 25, 2022

How does the grace period extension apply?

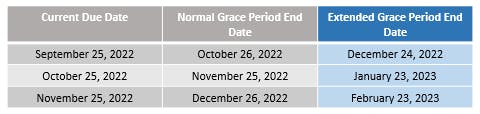

By policy contract, the policyholder has 31 days from the policy premium due date to pay the premium for the policy before it lapsed or switches to deduct the premium due from the policy’s account value. The extended grace period means that the Assured now has up to 90 days* from the premium due date to make a payment before the above action/s happen.

*Please be advised that Global Health Access policyholders will have a grace period of up to 60 days from current due date to settle their premiums.

Does this mean that I will be billed after 90 days from my due date?

No, our normal billing cycle will still be followed which means that you will be billed on the day of your due date. No changes in your due date, only the grace period will be extended.

I am enrolled to auto-pay, are you going to deduct the payment 90 days from due date?

a.Please be advised that affected policies enrolled on automatic payment schedule via bank account or credit card will still follow the normal billing cycle. Therefore, any premium due will still be automatically be debited from the Assured’s enrolled account (billing or debiting happens every 5th or 20th of the month depending on the Assured’s assigned cycle). However, unsuccessful debits will not incur any charge. The customer’s policy will not lapse nor will the premium be deducted from the account value unless the extended grace period ends. Should you wish to change your debit arrangement, please call our Customer Care hotline at (02) 8 581-5292 or email us at customer.service@axa.com.ph.

What will happen if I haven’t paid after the normal grace period?

a.While nothing will change in the billing, due dates, and premium reminders, policies that are covered by the program will be given considerations on policy lapse, automatic premium loan, and account value to premium as follows:

i.If the policy is lapsed and within the extended grace period, we will auto-reinstate the policy and waive the interest (if any)

ii.If automatic premium loan is applied, we will apply the payment to loan and waive the interest

iii.If account value to premium is applied, the charges will be reversed before applying payment as premium.

What will happen if I still don’t pay after the extended grace period?

a.Standard policy terms will apply on lapsed, automatic premium loan, account value to premium cases with no considerations.

Why am I still receiving payment reminders?

a.Premium reminders are system-generated and will still be received by customers covered by the program given that no changes will be made on billing and due dates. Customers are still encouraged to pay on time if possible. However, please disregard any lapsation notices within the extended grace period.

What fund price will be applied when I make a payment?

a.Fund price that will be applied will be based on the date of payment, not on the billing date. If payment was made on November 2022 for September 2022 due date, fund prices for November 2022 will be applied.

Can I file for a claim on my Global Health Access and/or Health Care Access policy during the extended grace period

a.Should a claim occur during the extended grace period for Global Health Access or Health Care Access policies, policyholders will be asked to settle the premium due first before the settlement of the claim.

What will happen to premiums due starting November 26, 2022?

Premiums due starting November 26, 2022 will revert to the normal 31-day grace period.

Loading Content...