TO OFFER YOU A BETTER EXPERIENCE, THIS SITE USES COOKIES, INCLUDING THOSE OF THIRD PARTIES. TO FIND OUT MORE, CONSULT THE PRIVACY POLICY

Sow, Grow, Reap: Easy Money Habits for Business Success

Do you see yourself owning and managing your nail and hair salon someday? Or are you aspiring to be the full-time boss of your flower shop or ice cream store? If you’re over the moon with the idea of doing something you genuinely love while earning money, maybe it’s your calling to become a businesswoman.

Although there are a lot of factors to consider in starting your own business, practicing simple financial habits every day can be a great start. Here's how you can save up for your capital to turn your dream business into reality.

Live within your means

Spend only what you have and avoid buying things that will exceed your budget. You just need your good old willpower to buy items that you need and discern on the items that you want, even if they are at a discount. By controlling your finances, you can save more for your business fund.

Set a budget and track your expenses

See where your money goes using a budget tracker app or an Excel file. This will help you better examine how much you spend on essentials and how much goes into other items. From there, you’ll know where to cut back or ease up on your spending. This would also be a great tool to use to monitor your finances once you start your business.

Set your financial mantra

Create your personal mantra on handling finances, and then use it as a reminder to guide your spending habits. It can be as loose as “I'll only shop online if shipping is free and if I really need that item,” or as strict as “I can only eat out once I’ve paid my credit card bill in full.” Starting this habit can help you set boundaries and break your bad money practices that might affect your business someday.

Make a list

If you’re an impulsive buyer, it’s best to list down the things you need before you shop. Also, to avoid buyer’s remorse, you can try doing these things: survey your options, conduct research, and time your purchase with deals and discounts. You can apply this tip as well to ensure proper budget allocation for your future business.

Have a financial planning guide

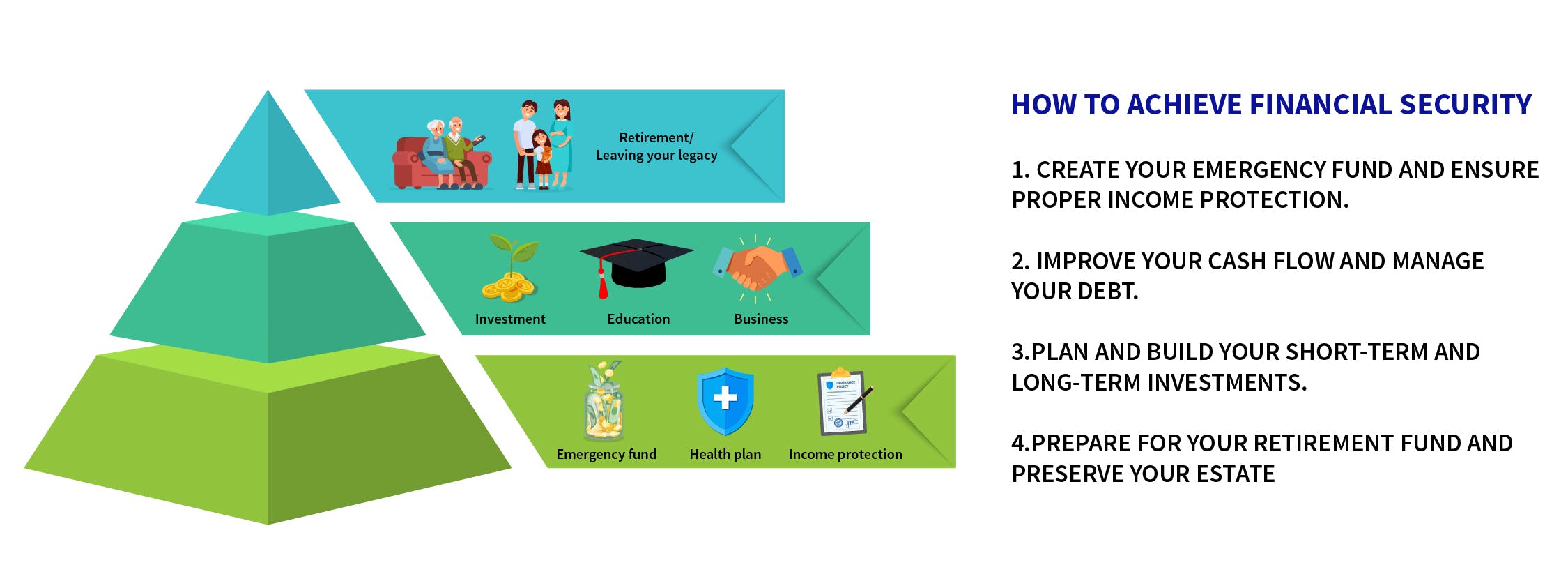

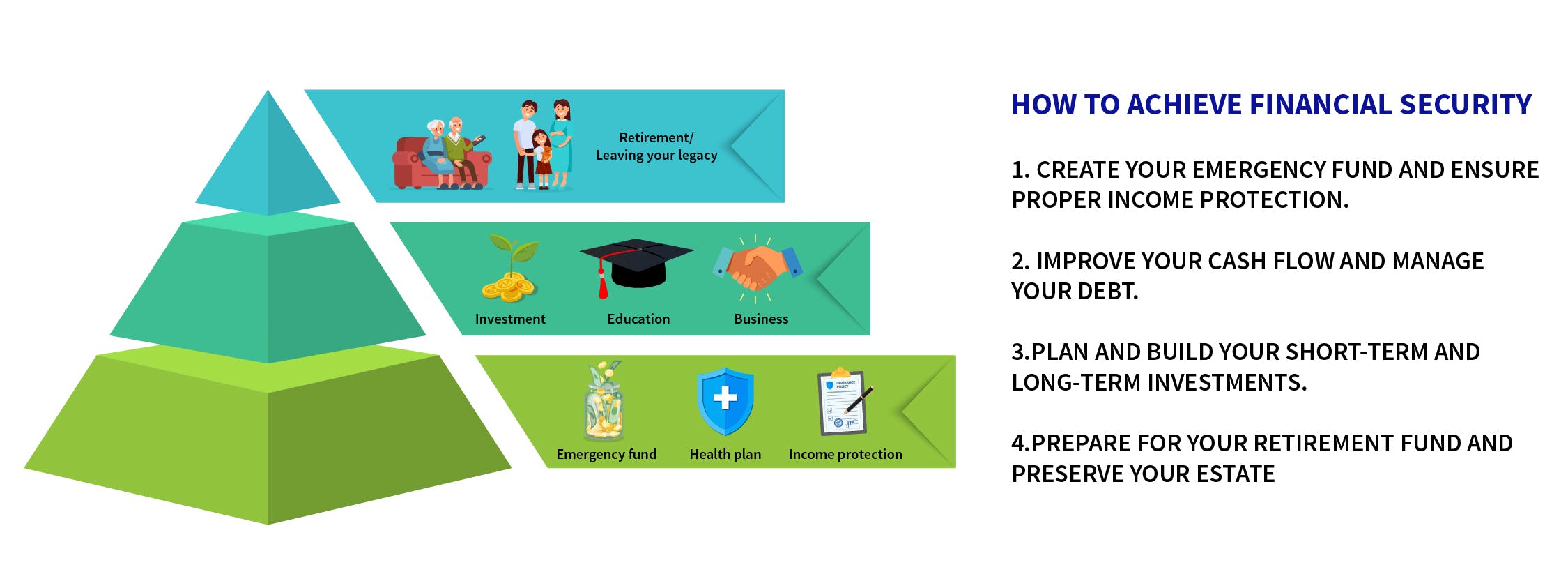

When it comes to prioritizing your financial goals, it is best to refer to the financial planning pyramid as your guide. This will help you focus on achieving financial security while you build your business with ease.

Invest your money

Set aside some funds and invest your money so it can grow over time. Keep yourself informed about economic and market trends that may affect your investments. Consider getting an all-around insurance plan with an investment feature like AXA’s MyLifeChoice. With this you are not only financially protecting the future of your loved ones, you’re also expanding your portfolio to finance your business funds.

Practicing these good money habits consistently is a good foundation to mold and shape you as a future entrepreneur. It will entail a lot of discipline and hard work, but you’ll be surprised at how these small steps can help you achieve your business goals sooner rather than later.

Kick start your entrepreneurial journey with AXA, your financial partner for life. With its savings and investment plans like MyLifeChoice, you can be more confident in starting your dream business.

Know you can game plan your way to opening your first business while getting financial protection! Contact an AXA financial advisor today for more information.

Loading Content...