TO OFFER YOU A BETTER EXPERIENCE, THIS SITE USES COOKIES, INCLUDING THOSE OF THIRD PARTIES. TO FIND OUT MORE, CONSULT THE PRIVACY POLICY

Emma by AXA Frequently Asked Questions

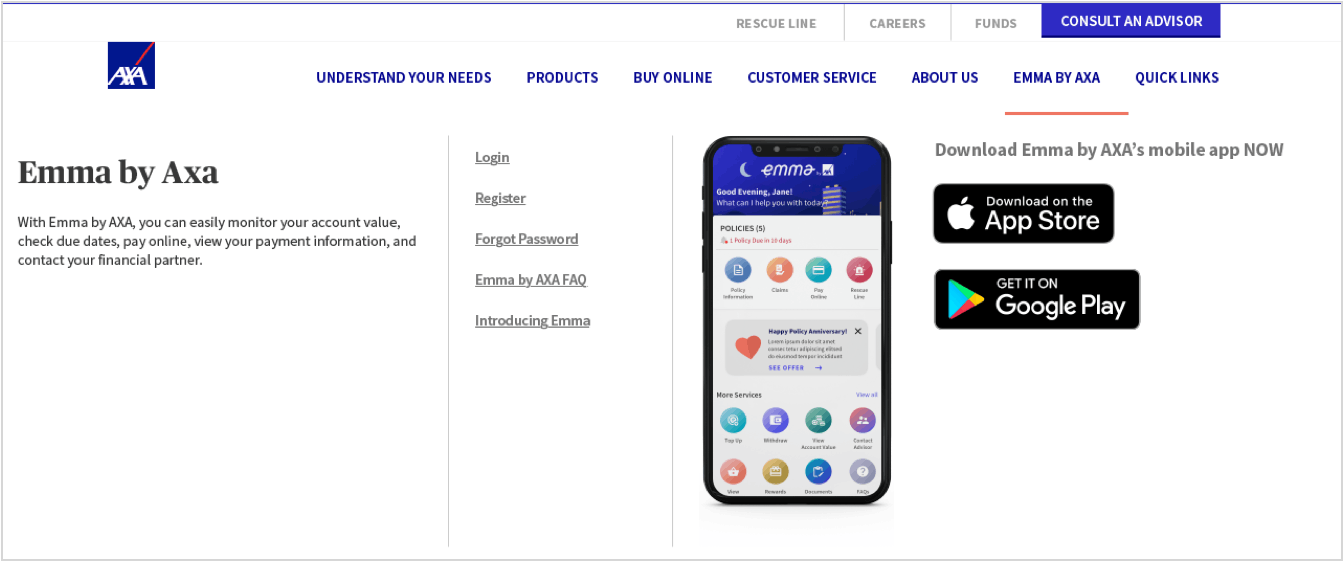

AXA Philippines, global leader in insurance, launched MyAXA, a mobile phone app that brings relevant information to their 811,000 strong customers in the country anytime, anywhere.

“We are building a community with our customers and MyAXA is one of our digital initiatives that would like to reinforce that,” says John Hilson, Chief Transformation and Operations Officer of AXA Philippines. Policy information like the payment schedules of their premiums can be viewed, as well as the digital copies of their official receipts. Other details like the account value of their chosen plan, and the contact details of their AXA Financial Partner is likewise conveniently accessible in MyAXA.

Support | Login | FAQs Web | FAQs Mobile Apps

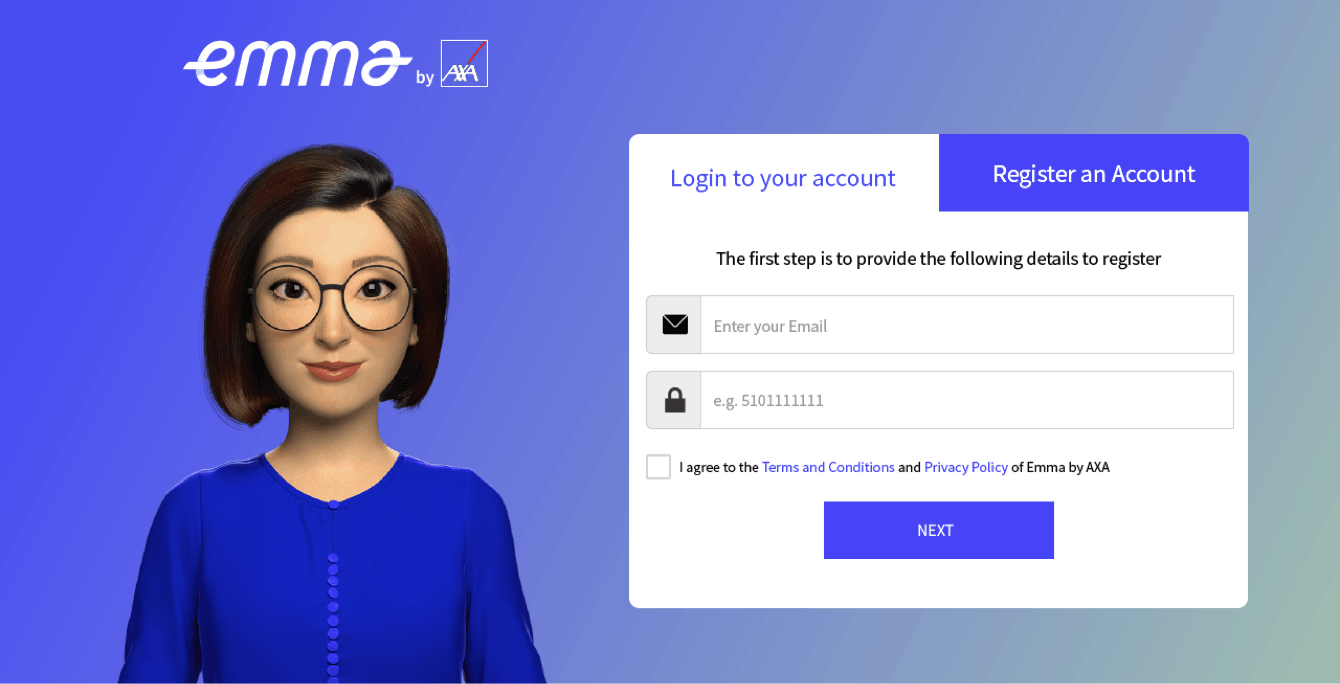

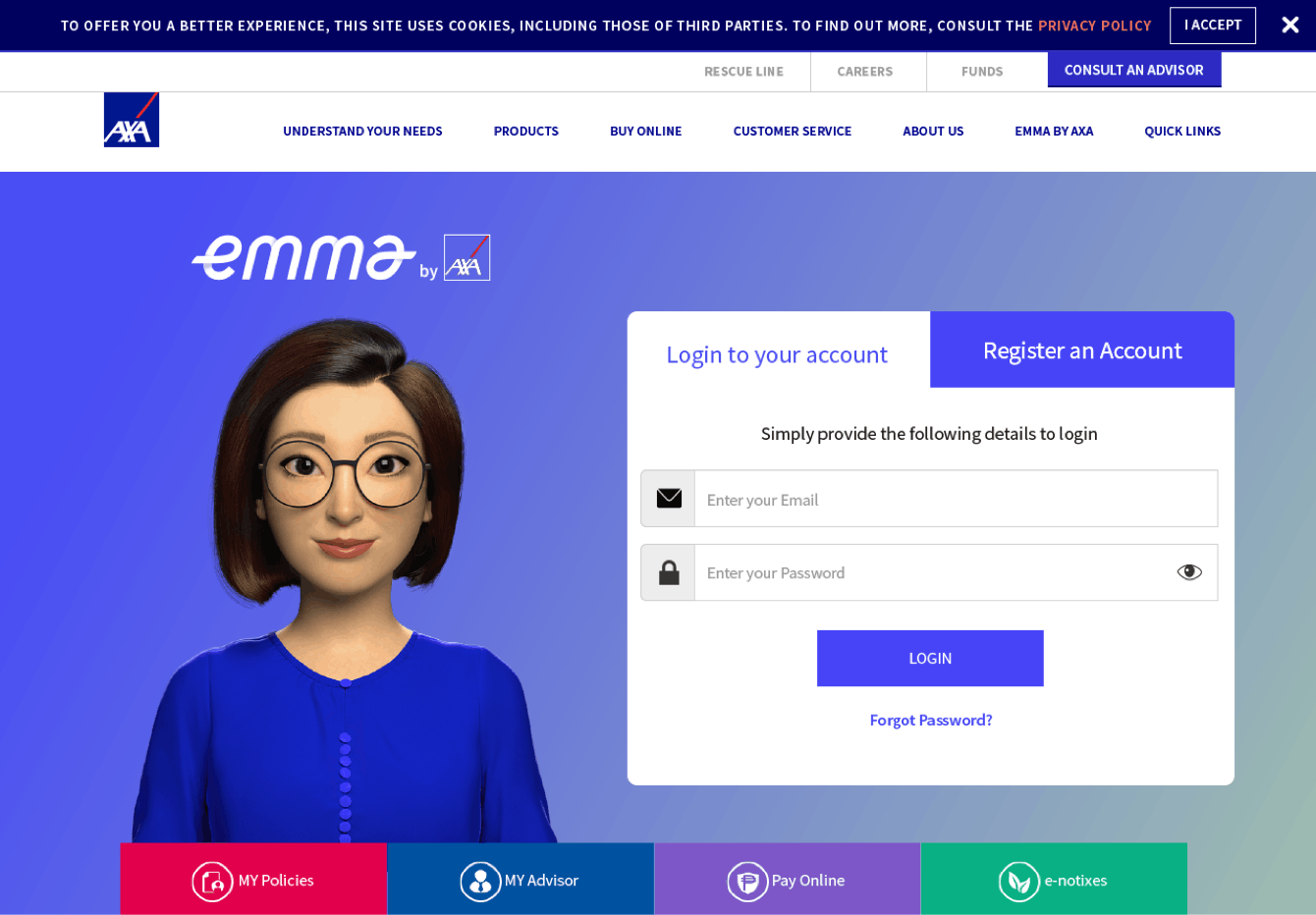

User's Guide on Web

Here are the easy steps in navigating this page so you can maximize all its features and make the most out of your online experience.

On the upper right corner of the AXA Corporate website, simply click on the Emma by AXA Icon and select Register on the dropdown menu.

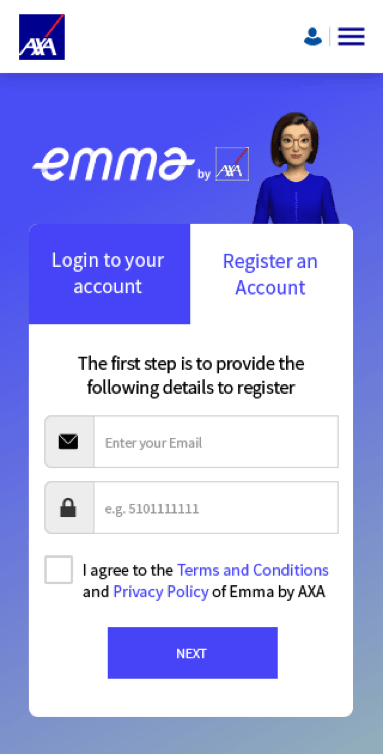

Key in your E-mail address and ten digit Policy number. Please make sure to use the e-mail address you have provided during Insurance application.

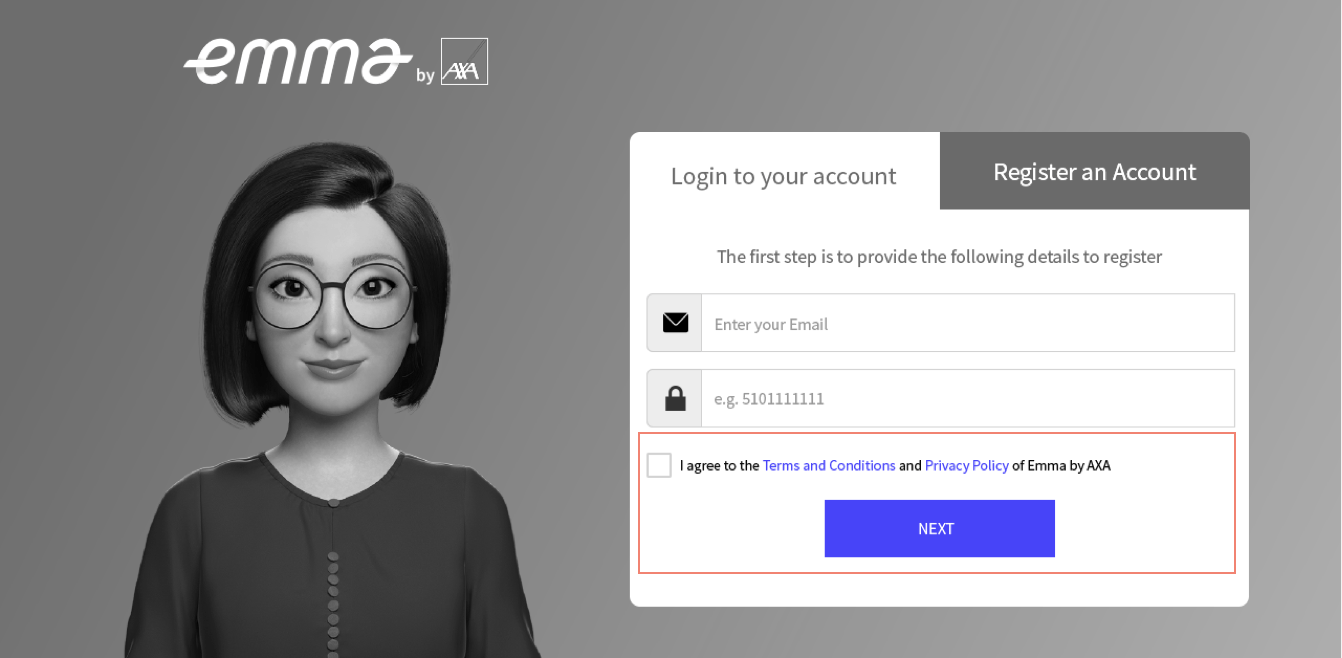

Agree on Emma by AXA’s Terms & Conditions and Privacy Policy by ticking the check box then click NEXT.

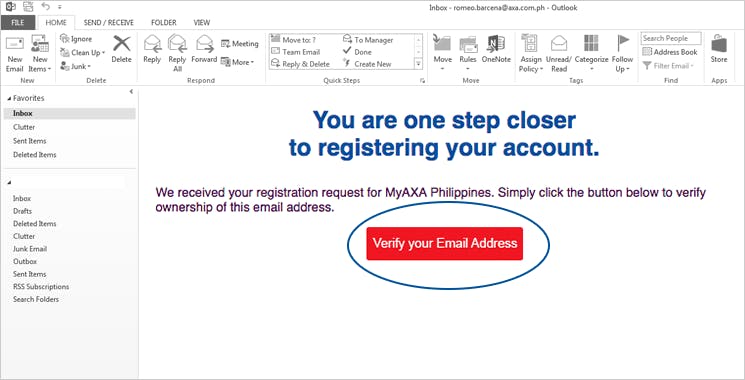

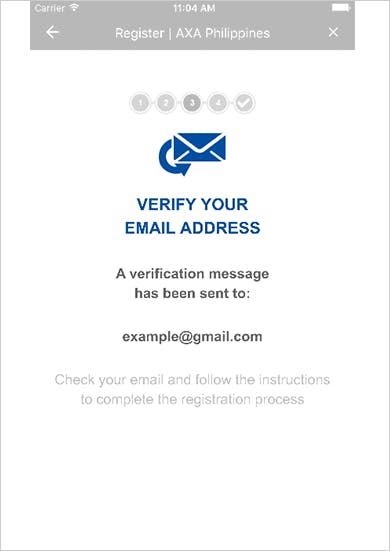

Emma by AXA will forward a verification message to your e-mail. Simply click the button to verify your e-mail address. (picture of button)

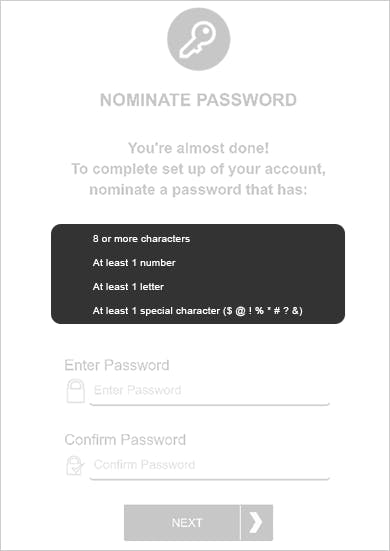

Emma by AXA will prompt you to provide a password following the given combination criteria.

8 or more characters

At least 1 number

At least 1 letter

At least 1 special character ($ @ ! % * # ? &)

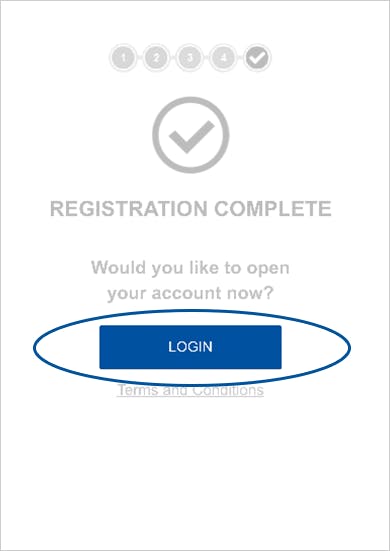

CONGRATULATIONS! You are now Registered on Emma by AXA, you may now log in to your account.

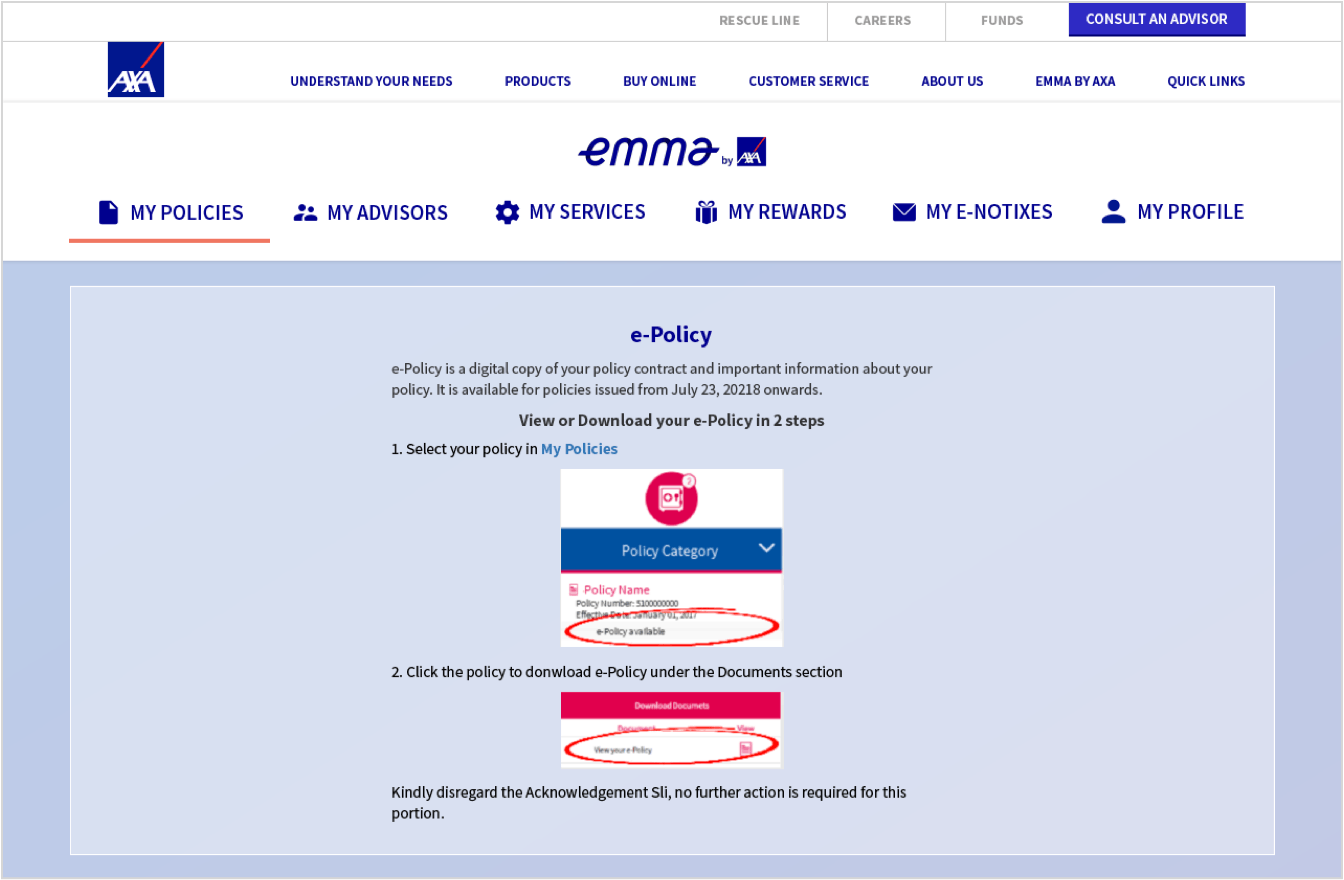

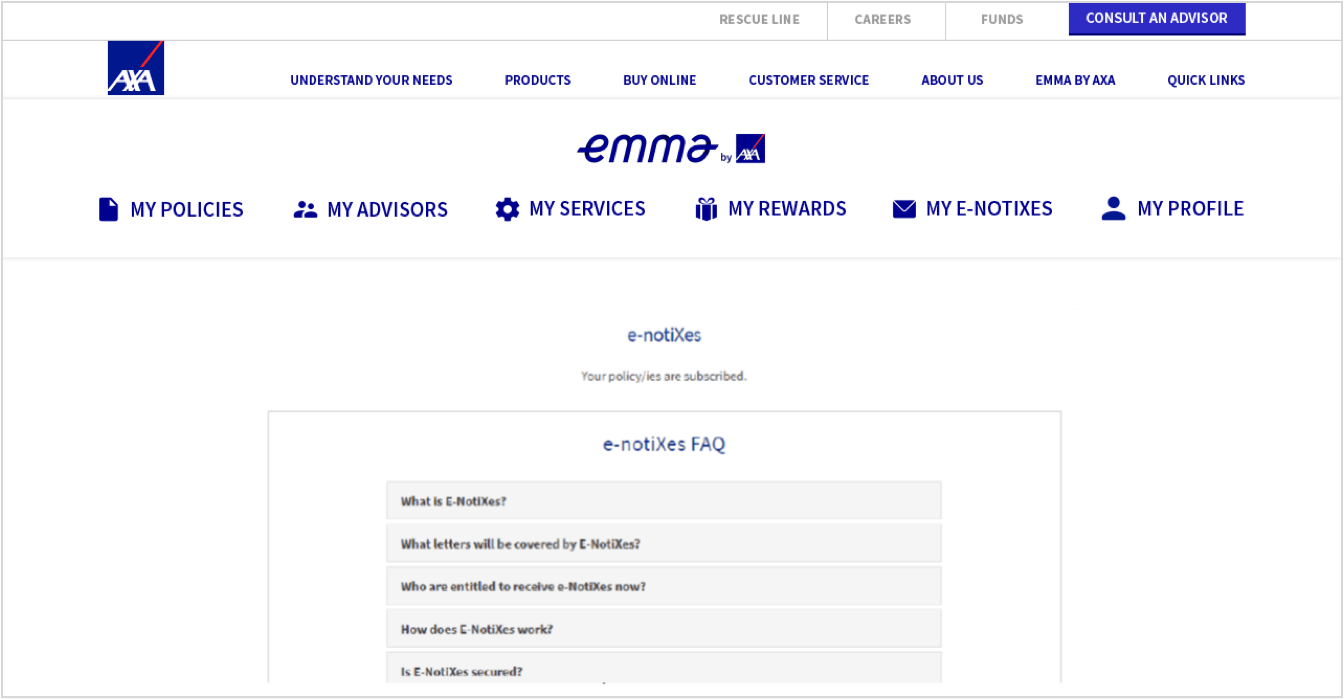

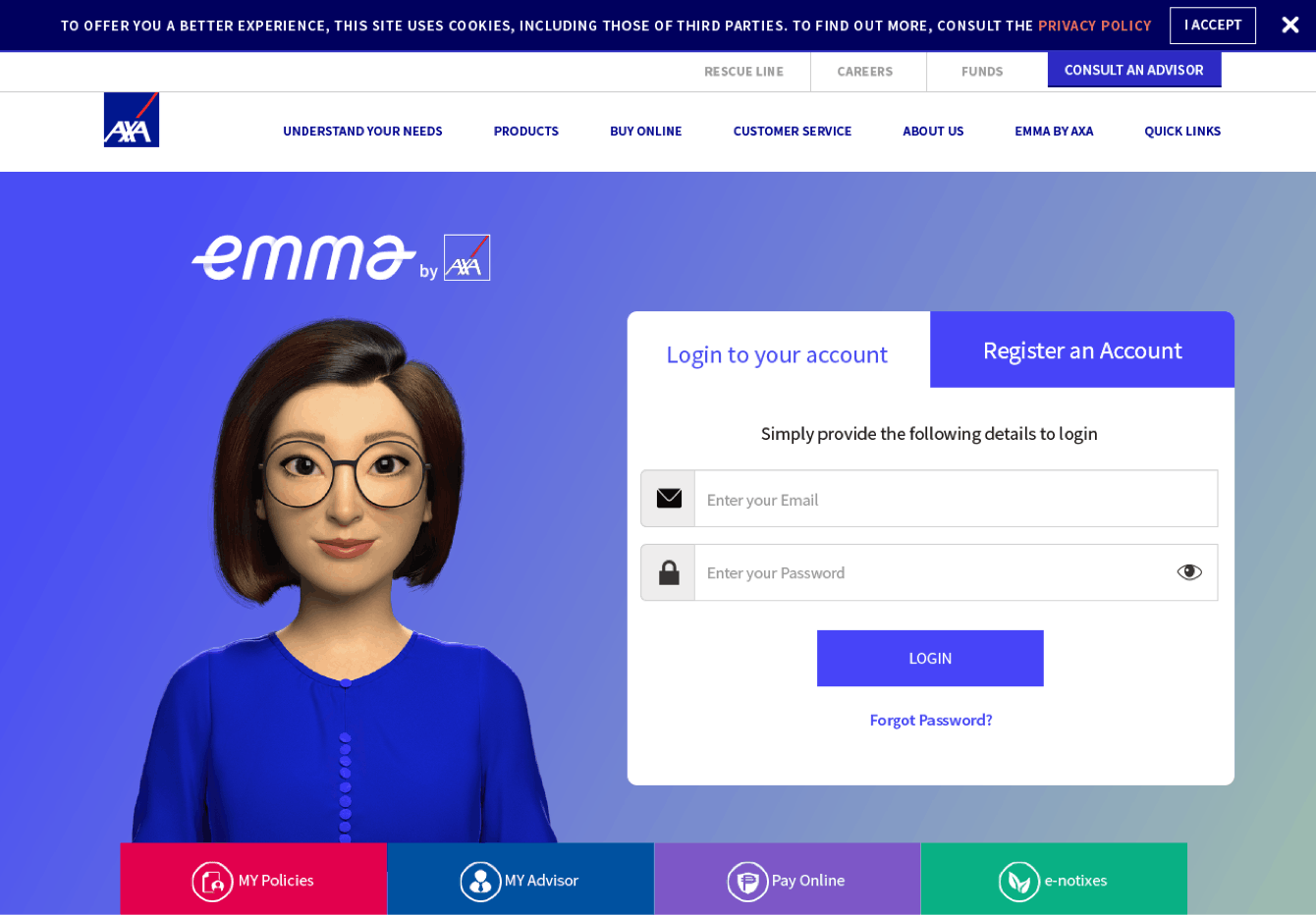

On the Emma by AXA Homepage you can conduct transactions concerning your policy with ease.

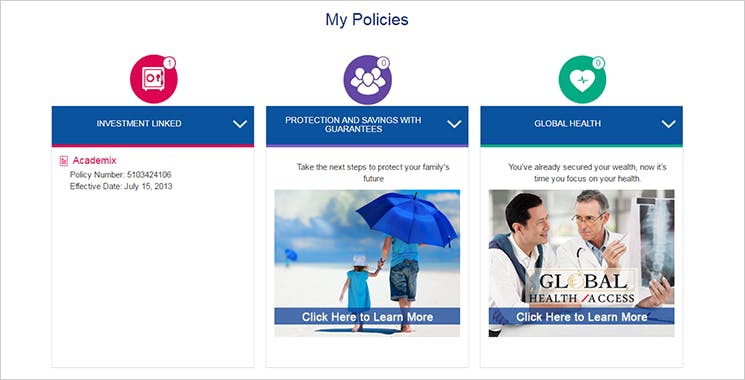

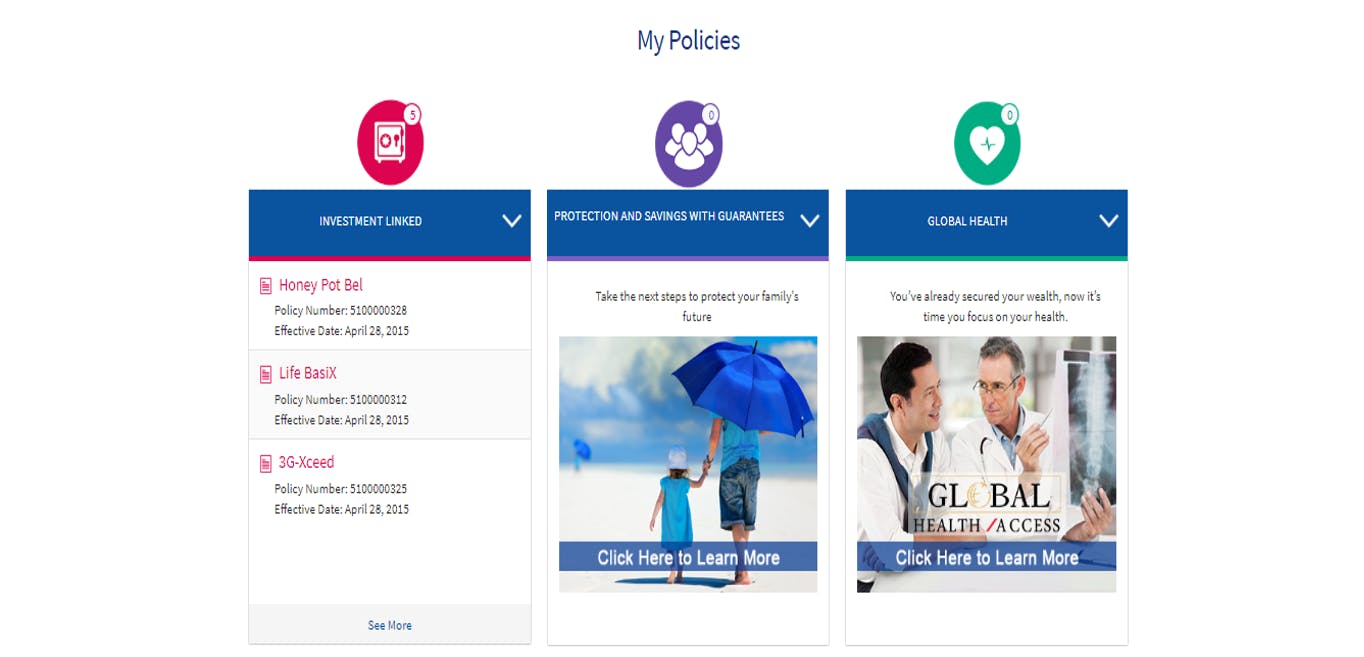

To view your policy information, click on My Policies

If you own multiple policies, choose the policy you want to view.

Investment Linked, Protection and Savings with Guarantees and Global Health

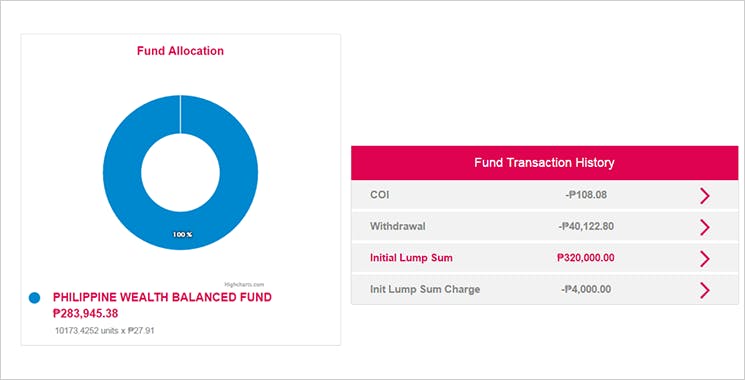

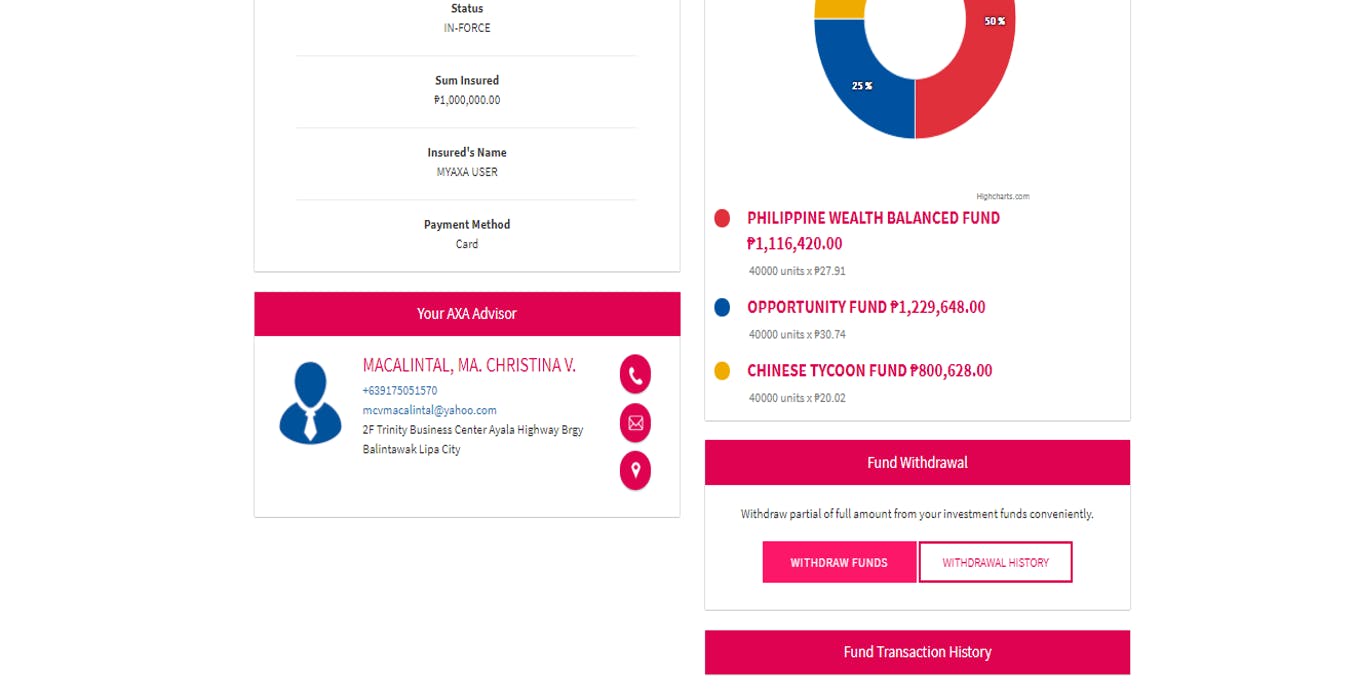

For Investment Products, you can view your current account value, fund allocation, fund performance and fund transaction history.

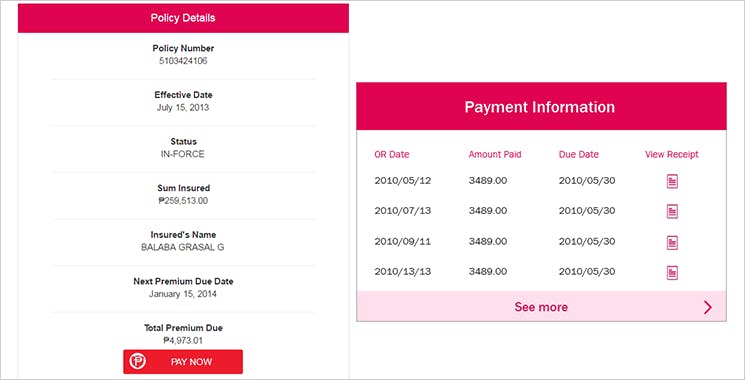

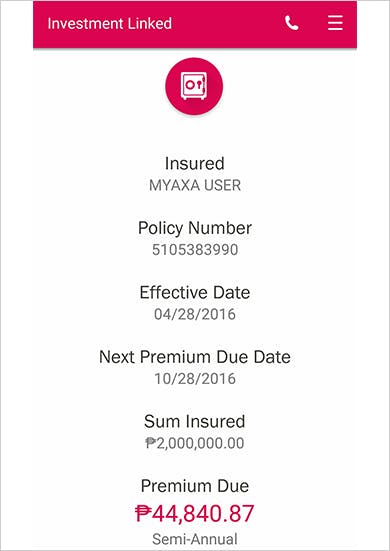

You can also view your premium due, payment mode and other payment information.

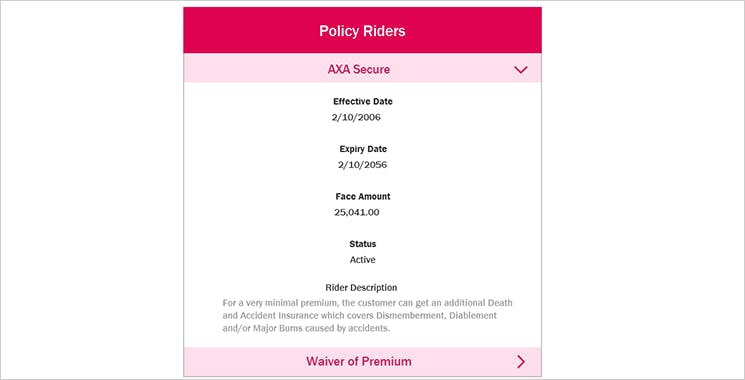

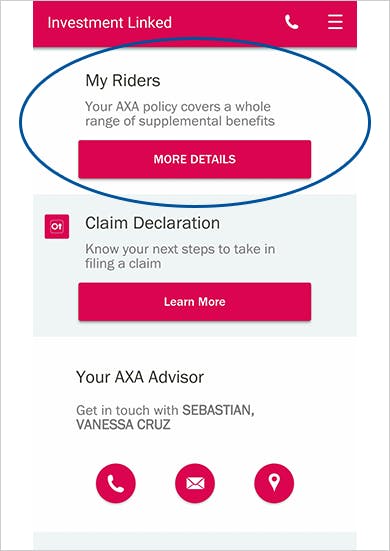

In case your policy has Riders attached to it, you can view the Rider details as well.

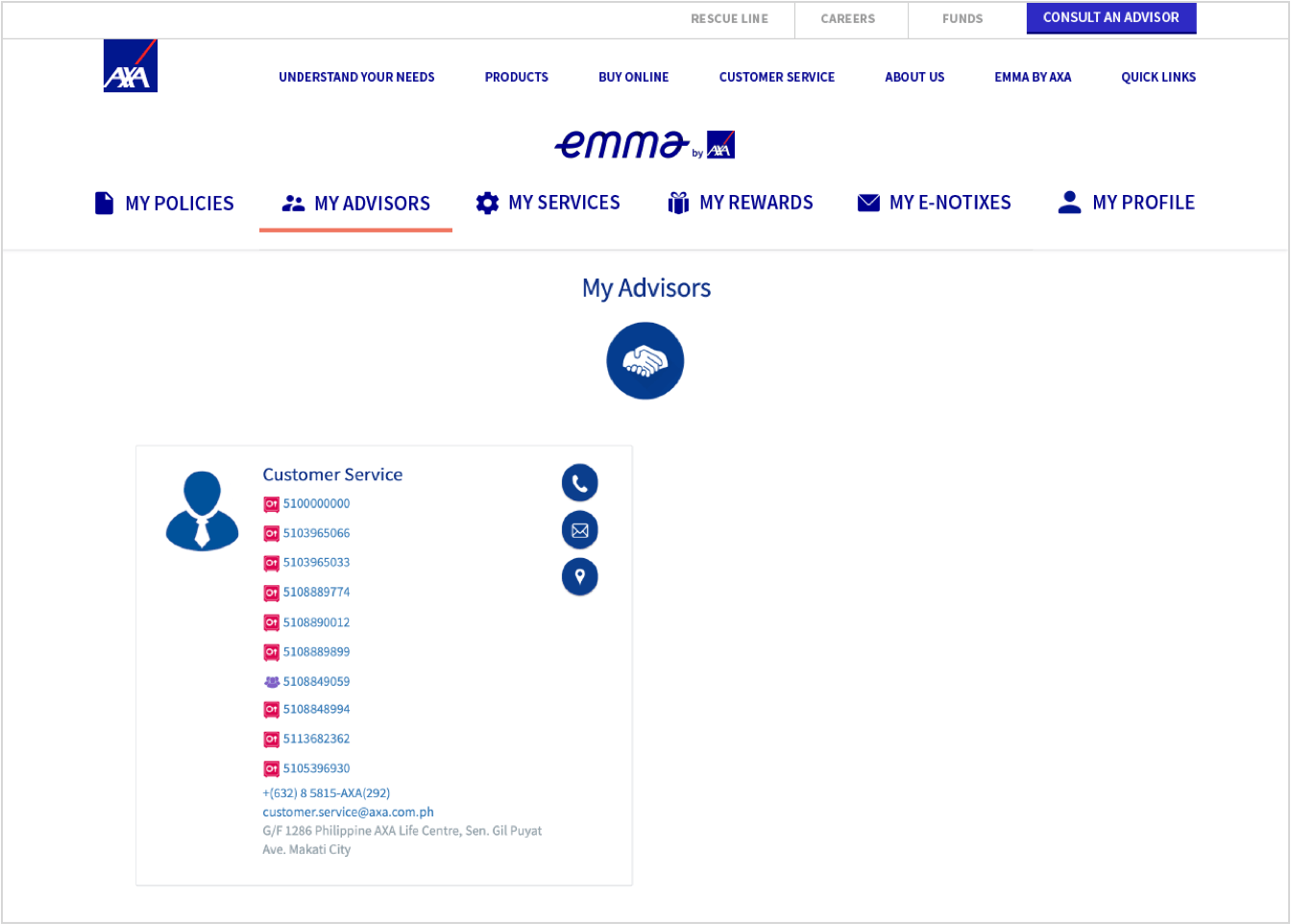

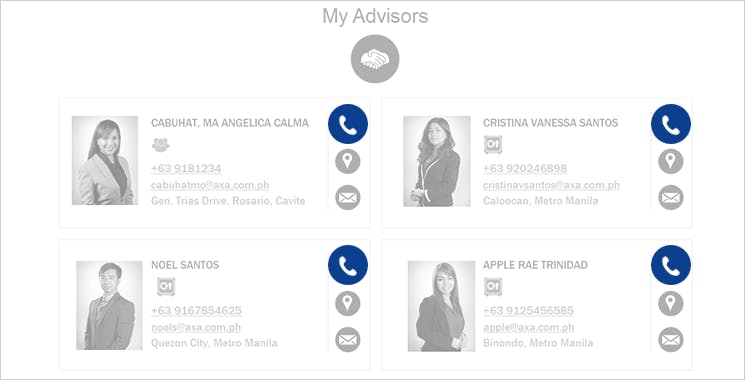

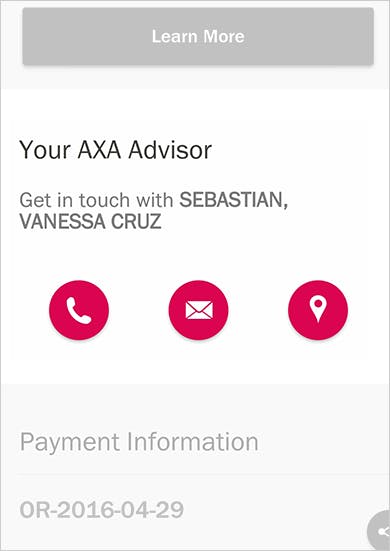

Contacting a financial Advisor is now made easy with Emma by AXA

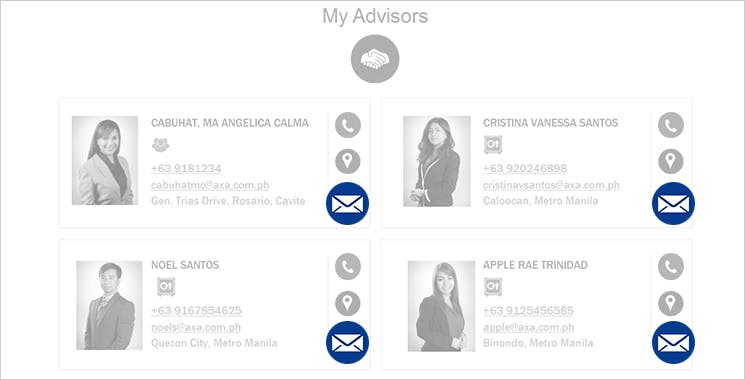

You can directly contact your AXA Financial Partner, simply click My Advisors

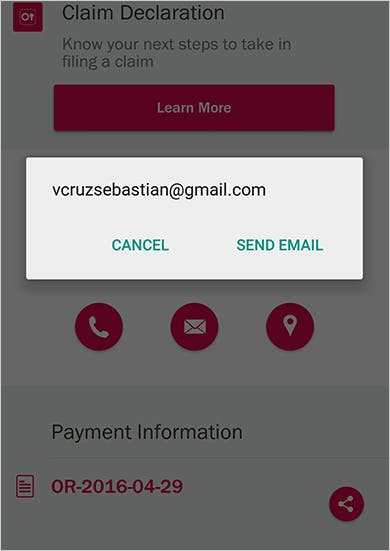

You can send a message by clicking the email icon on each of the displayed Advisors

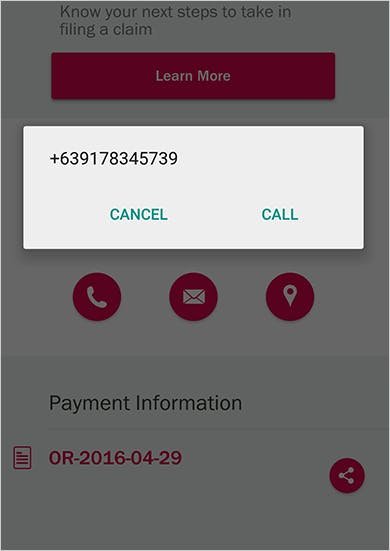

If you're viewing Emma by AXA through your mobile phone you have the option to talk to your advisor by clicking on the call button

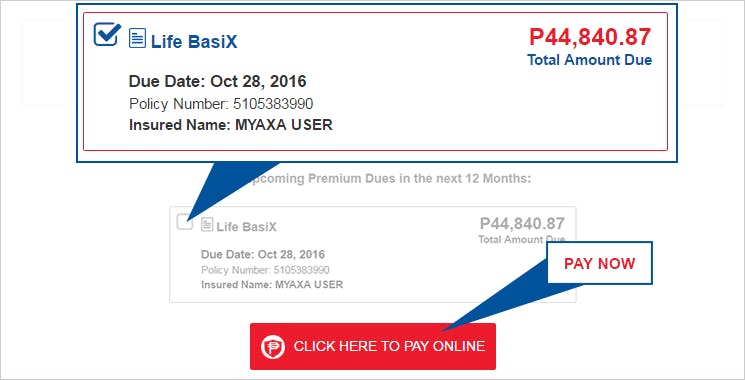

Now we've made it easier for you to pay your premium. With Emma by AXA, you can pay your premium online in a few easy steps

You can directly contact your AXA Financial Partner, simply click My Advisors

Choose the policy or policies you wish to settle and click PAY NOW!

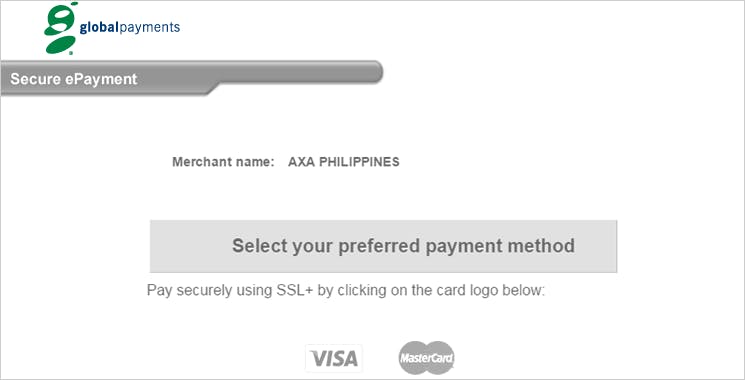

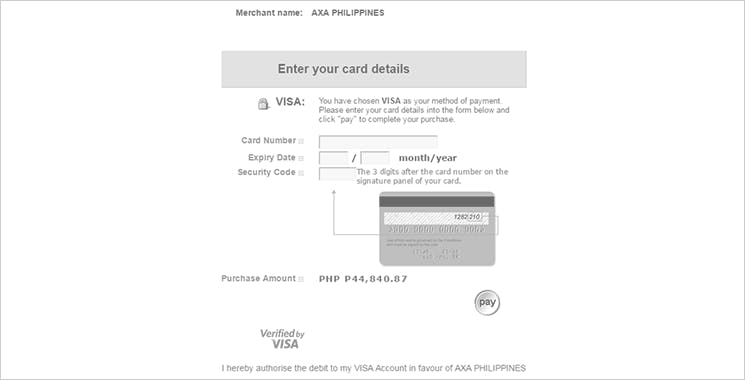

You will then be redirected to the Global Payment Secure Page

Select your preferred payment method

Input your card details, confirm your payment details then click proceed. And that's it, you've paid your premiums in few easy steps.

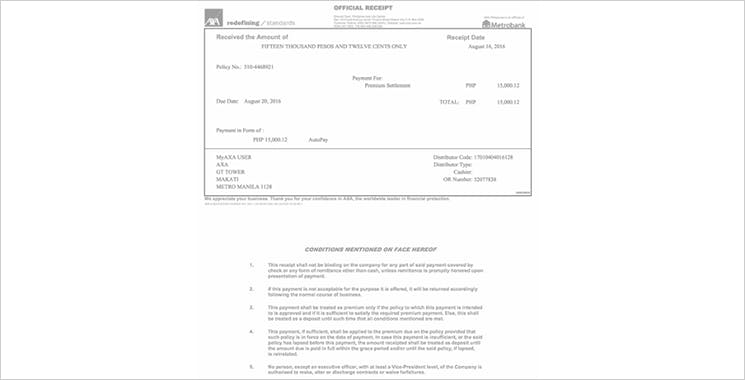

You have the option to print a copy of your transaction confirmation for your reference.

You can also download a PDF copy on your computer.

Your E-receipt will be sent to you within 3 working days and will be available for viewing in Emma by AXA

With Emma by AXA all your policy information is conveniently available anytime anywhere all under a click of a button

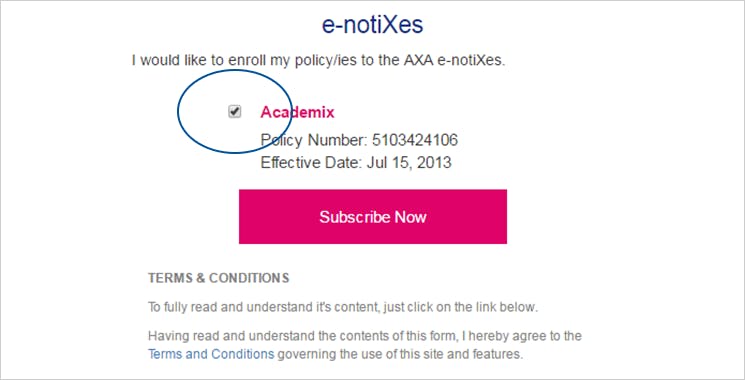

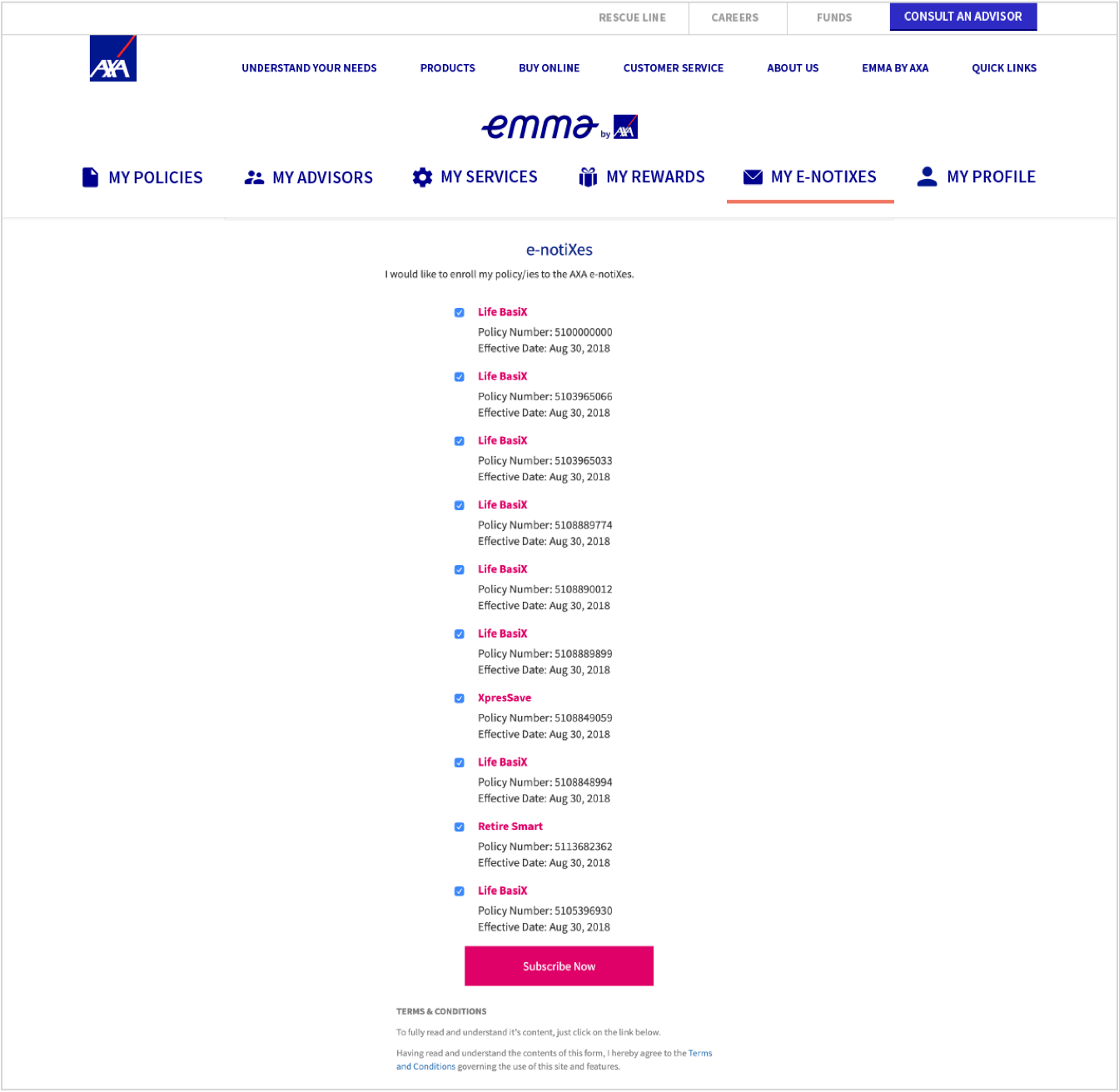

To view all your policy statements, click on the e-notiXes icon

Select a product that you wish to enroll to e-notiXes and then click SUBSCRIBE NOW.

You will start receiving information related to your subscribed policy number within the next five (5) days.

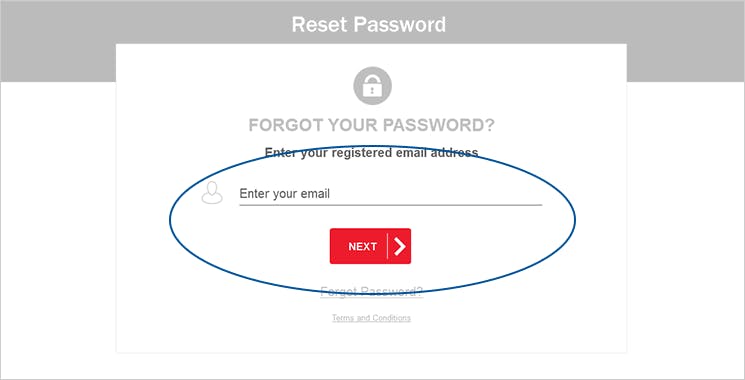

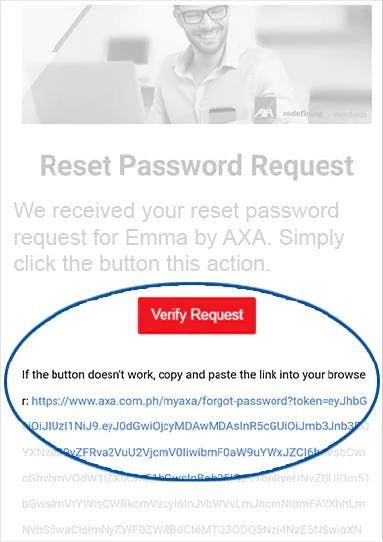

Follow these easy steps to reset your password.

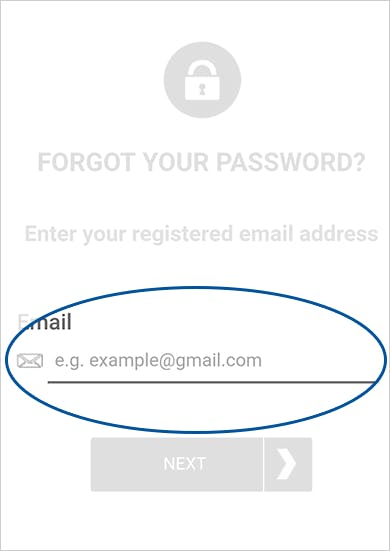

To reset your password, simply click on the FORGOT PASSWORD on Emma by AXA LOGIN Page

Then enter your registered email and click next.

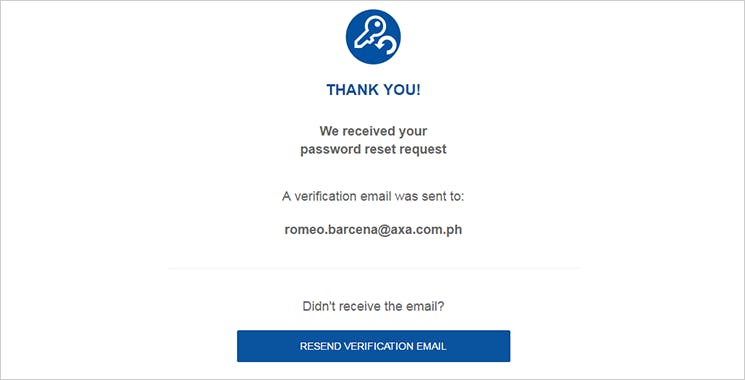

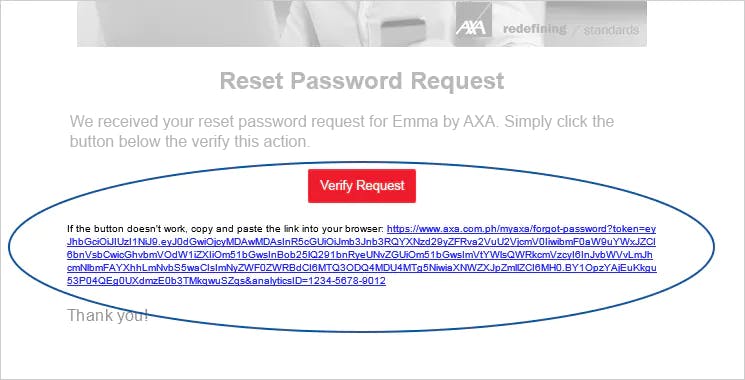

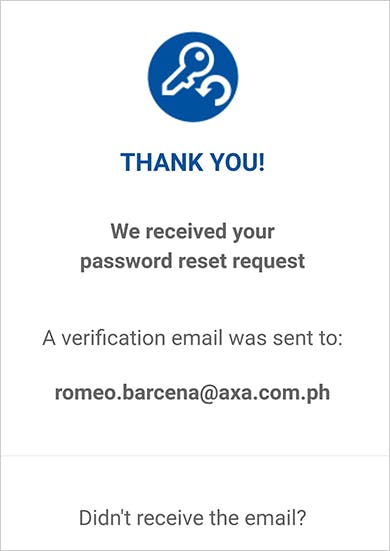

We will send a password reset request to your registered email address.

You will receive a verification to your provided email to reset your password. Simply Click Verify Request button or the link provided to continue the process.

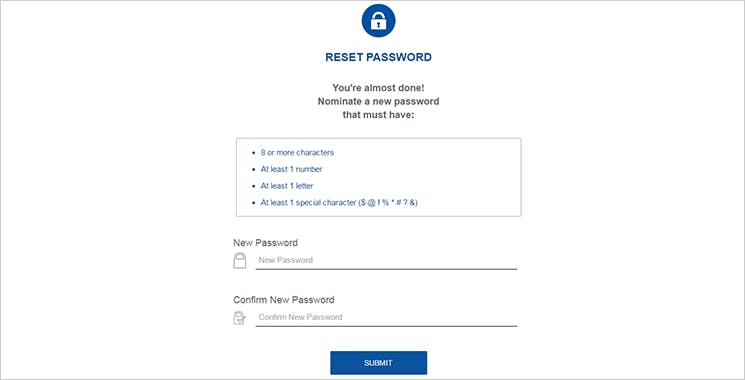

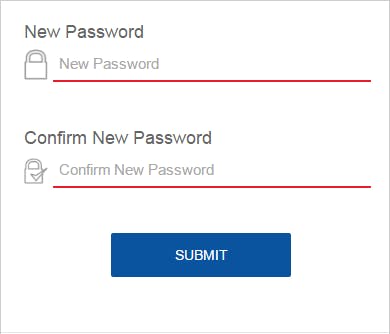

Congratulations! You may now create a new password with the following conditions:

8 or more characters

At least 1 number

At least 1 letter

At least 1 special character ($ @ ! % * # ? &

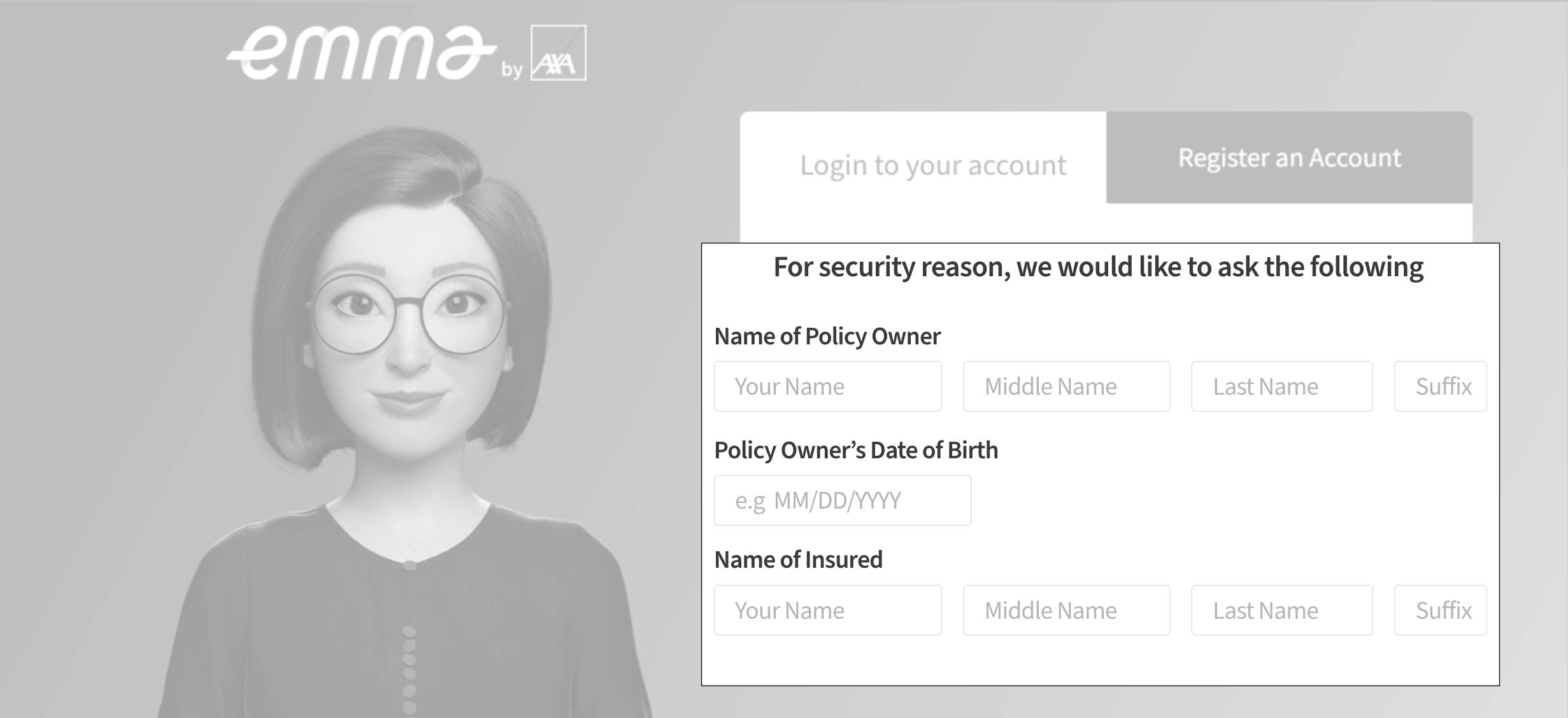

During the process of Registration there are instances that a customer will be asked for additional information for the following reasons:

In case you provide incorrect details for your E-mail Address and Policy Number, Emma by AXA will ask for the following:

a. Name of Policy Owner

b. Policy Owner’s Date of Birth

c. Name of Insured

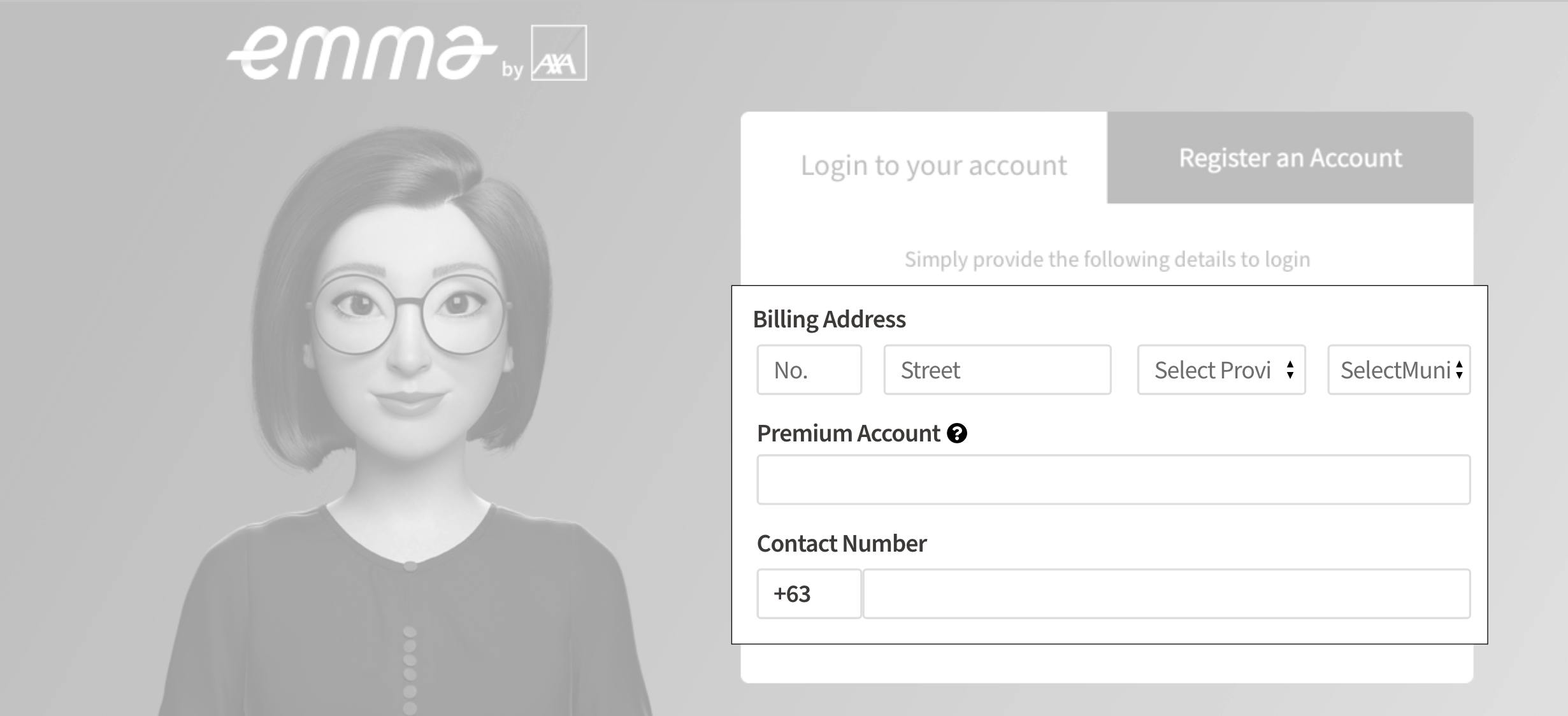

If there are still discrepancies on Policy Owner’s name, Date of Birth and Name of Insured, you will have to provide Emma by AXA with:

a. Billing Address

b. Premium Amount

c. Contact number

Registration to Emma by AXA will be temporarily parked at this point as we need to verify the information you provided. You will hear from us after two (2) days concerning your Emma by AXA registration.

You received an e-mail to inform you of the next action you need to undertake for your Emma by AXA registration process. We are taking these security measures to make sure that any information on your policies or any details you provide us are protected.

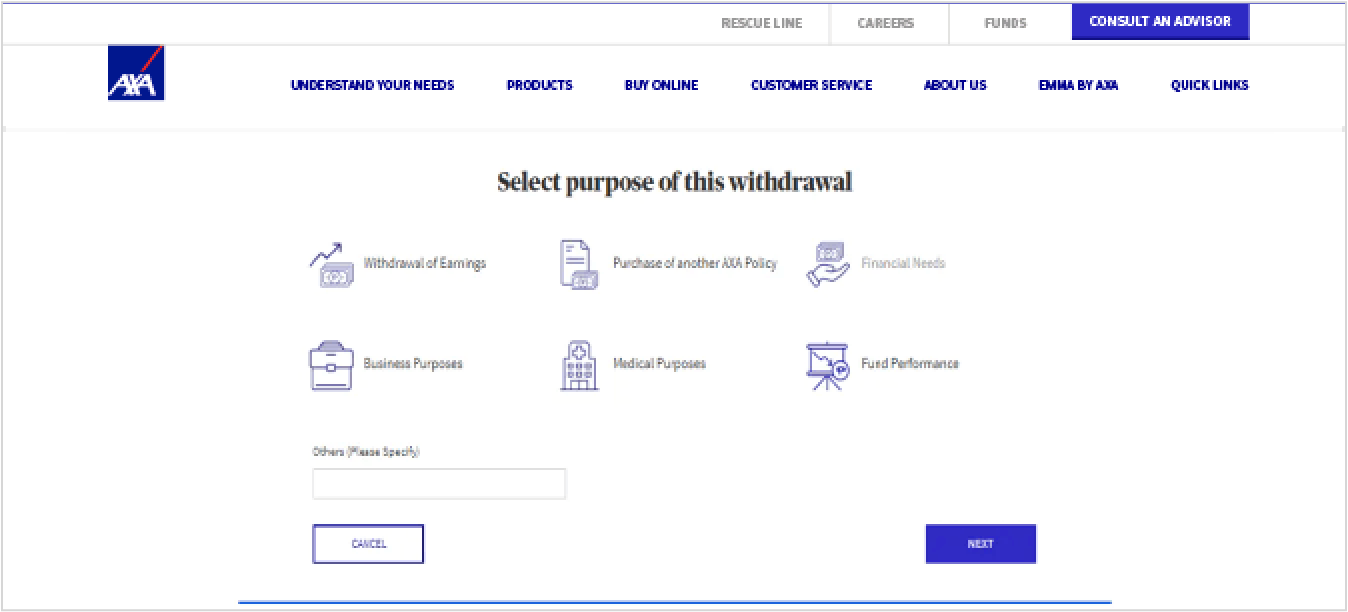

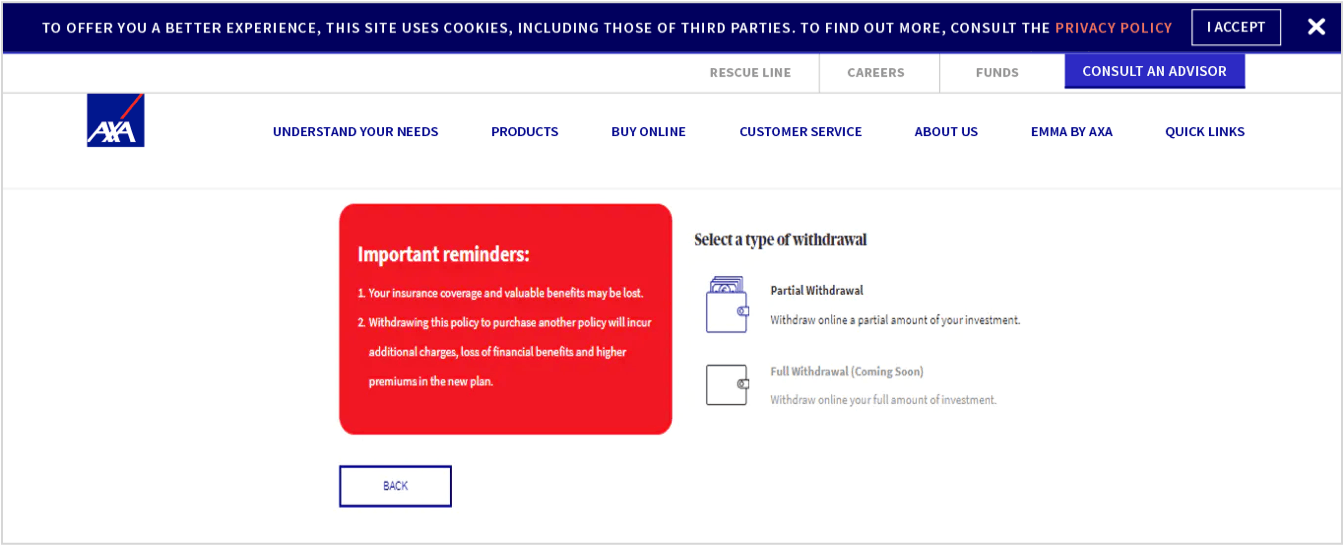

Withdraw your funds with ease with the use of Emma by AXA portal using the following steps.

On the Emma by AXA home page, click on My Policies tab.

Select on the policy where you want to withdraw.

Select "Withdraw Funds" to proceed.

Note that you will not be able to click the button if you are not eligible to withdraw.

Select the purpose of your withdrawal.

Select the type of withdrawal (full or partial).

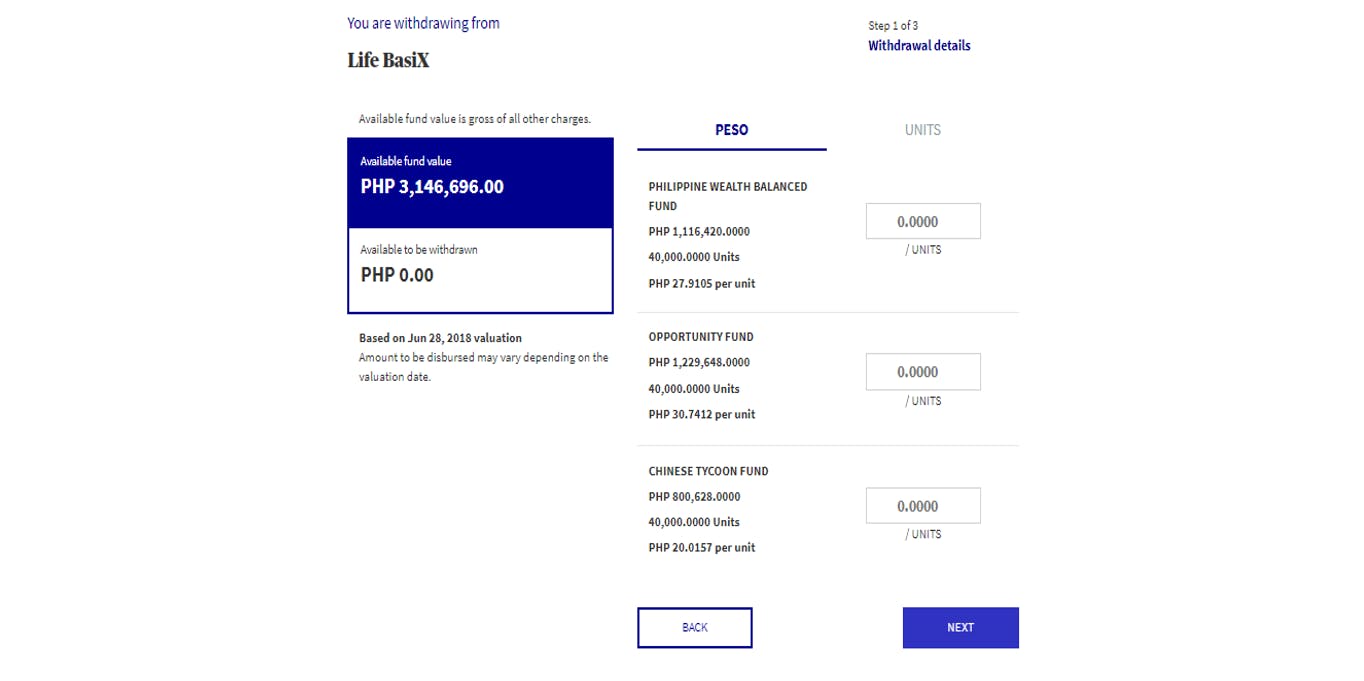

Details of the policy will be shown. If it’s a partial withdrawal, you will have to select the units or pesos that you want to withdraw per fund.

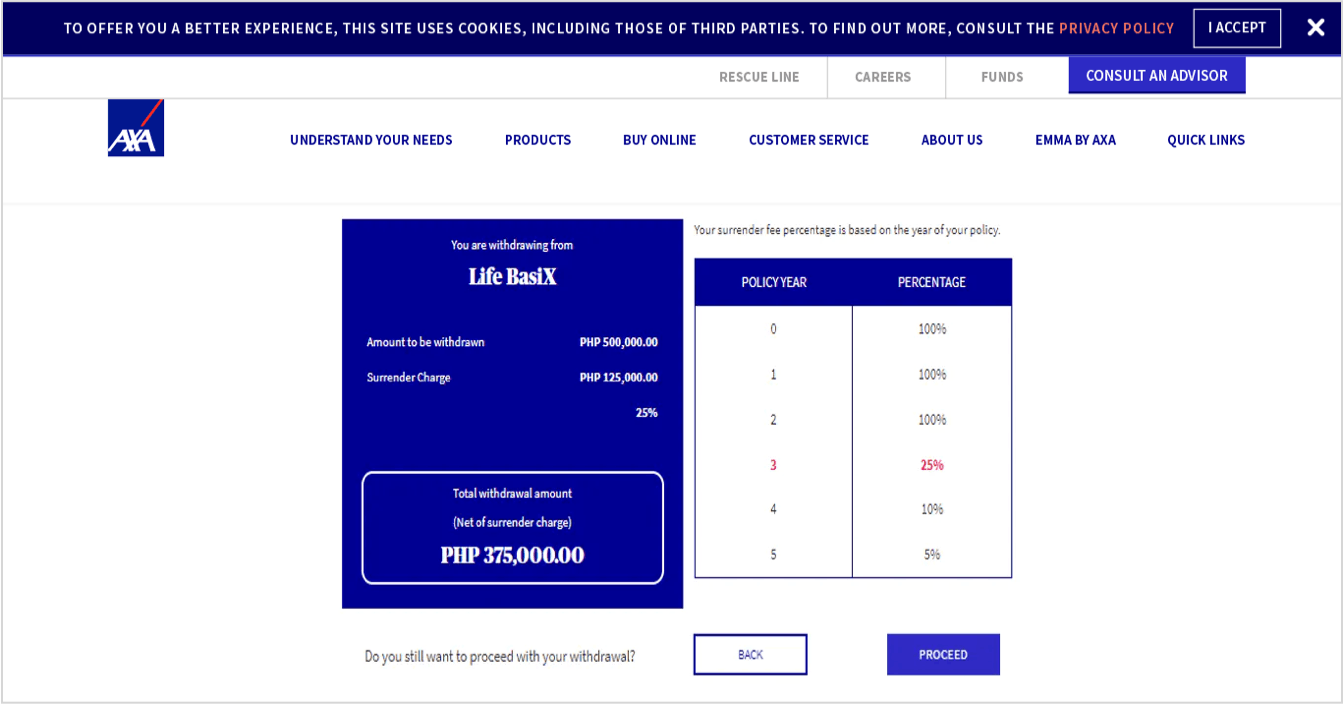

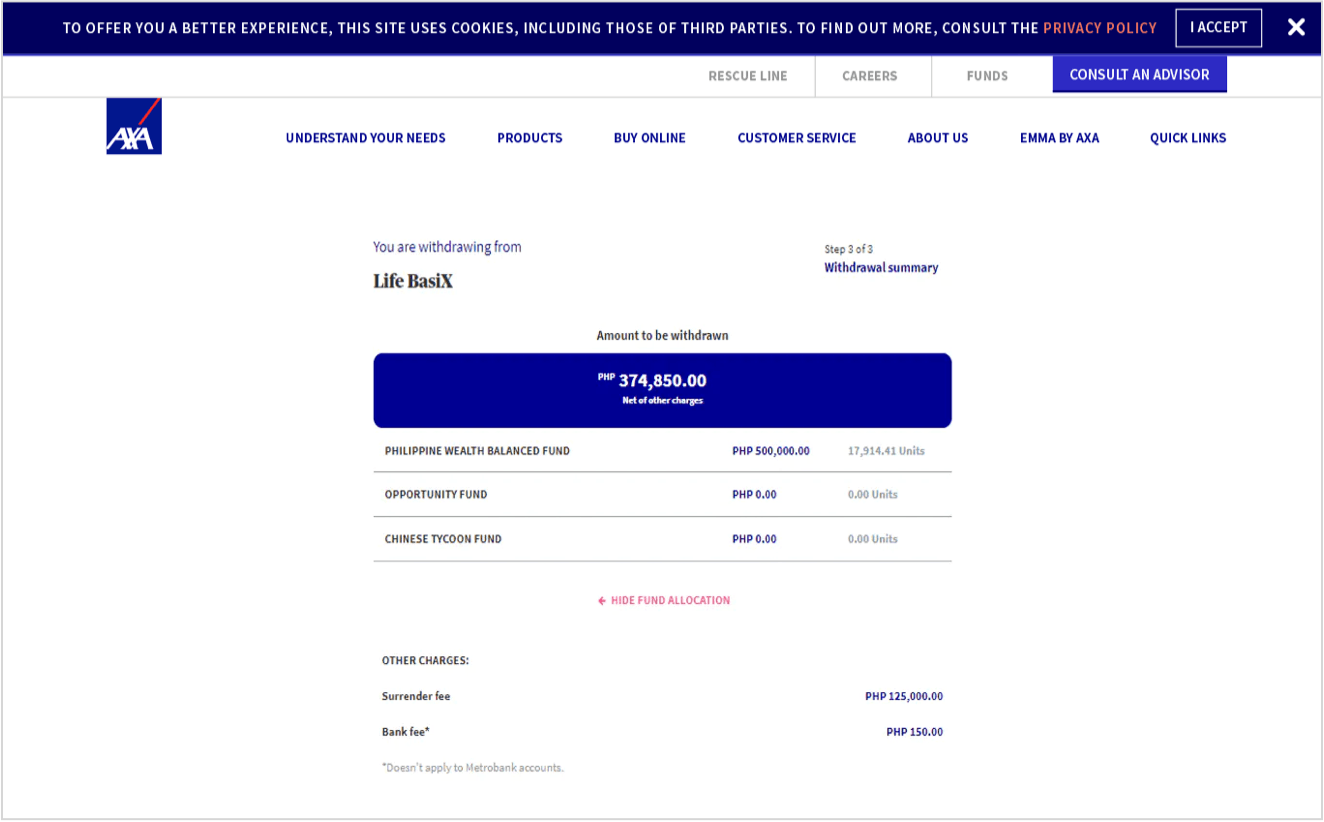

Details of the fund withdrawal amount and surrender charge (if applicable) will also be shown.

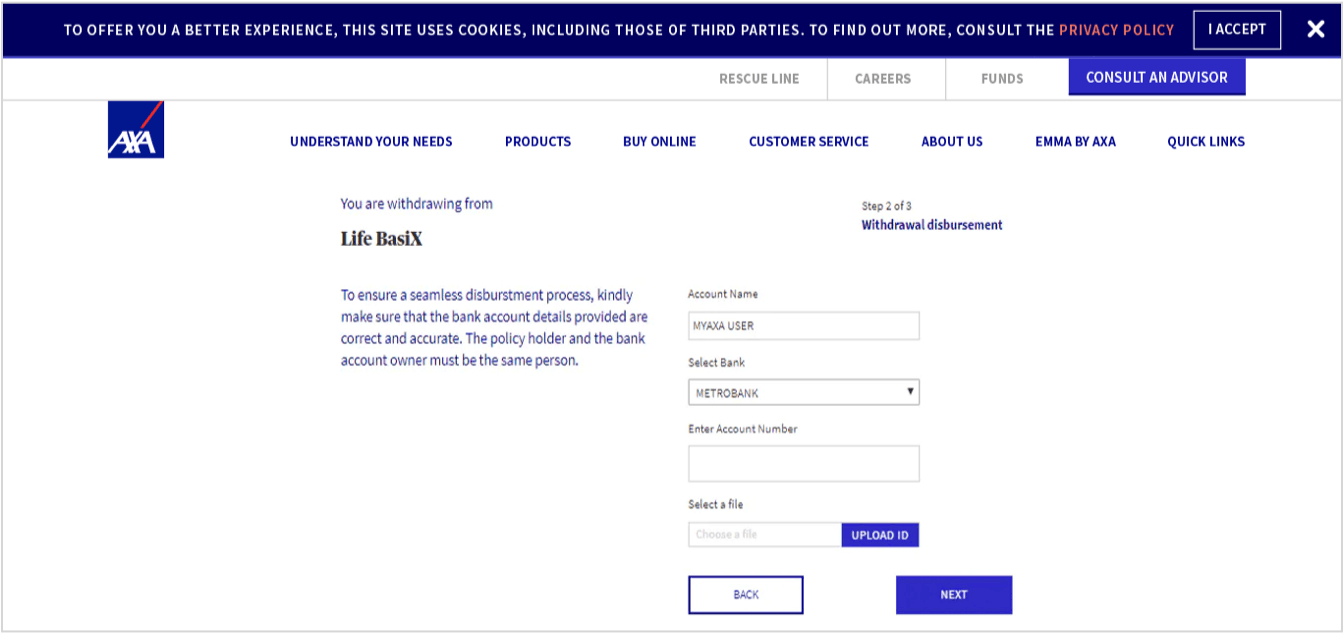

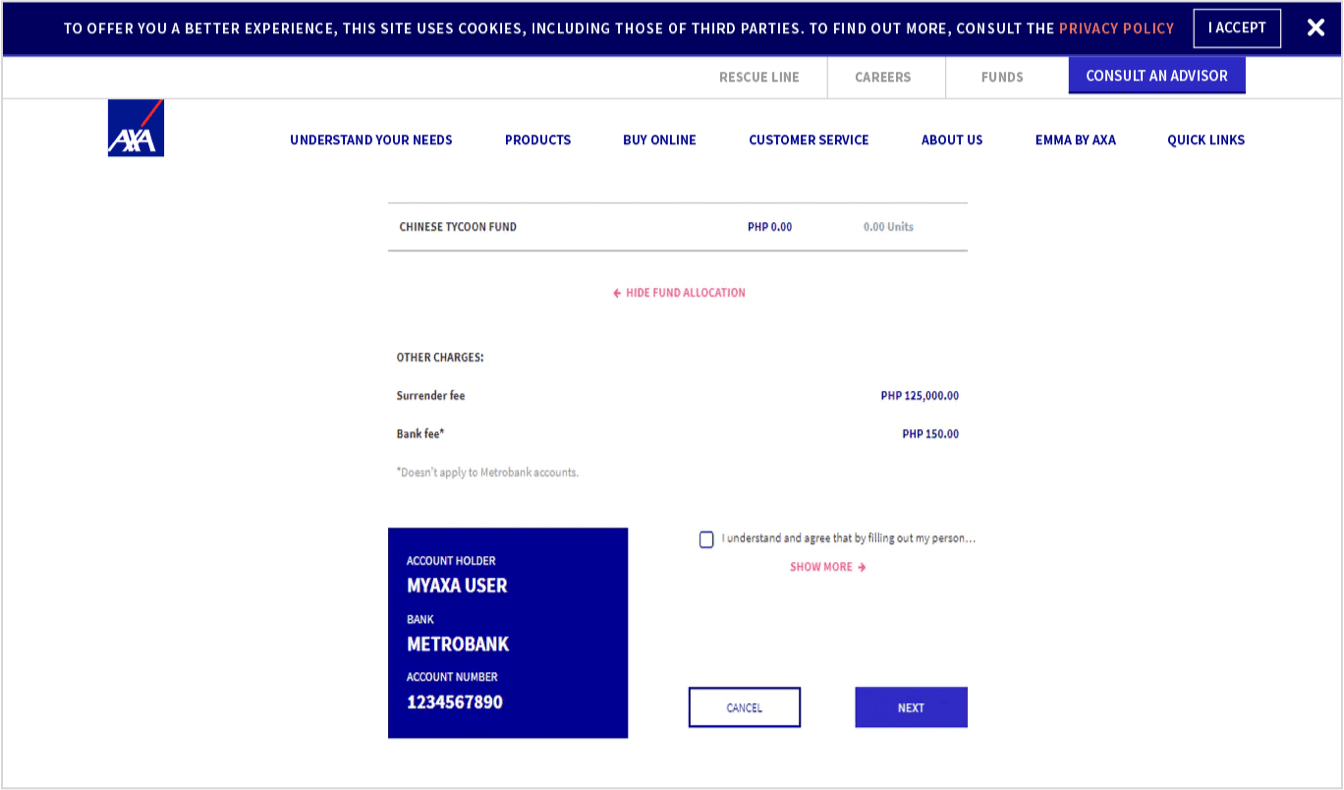

Fill up the form with your bank account details.

Emma by AXA withdrawal is only applicable for direct bank transfer. Bank account owner and policy owner should be the same.

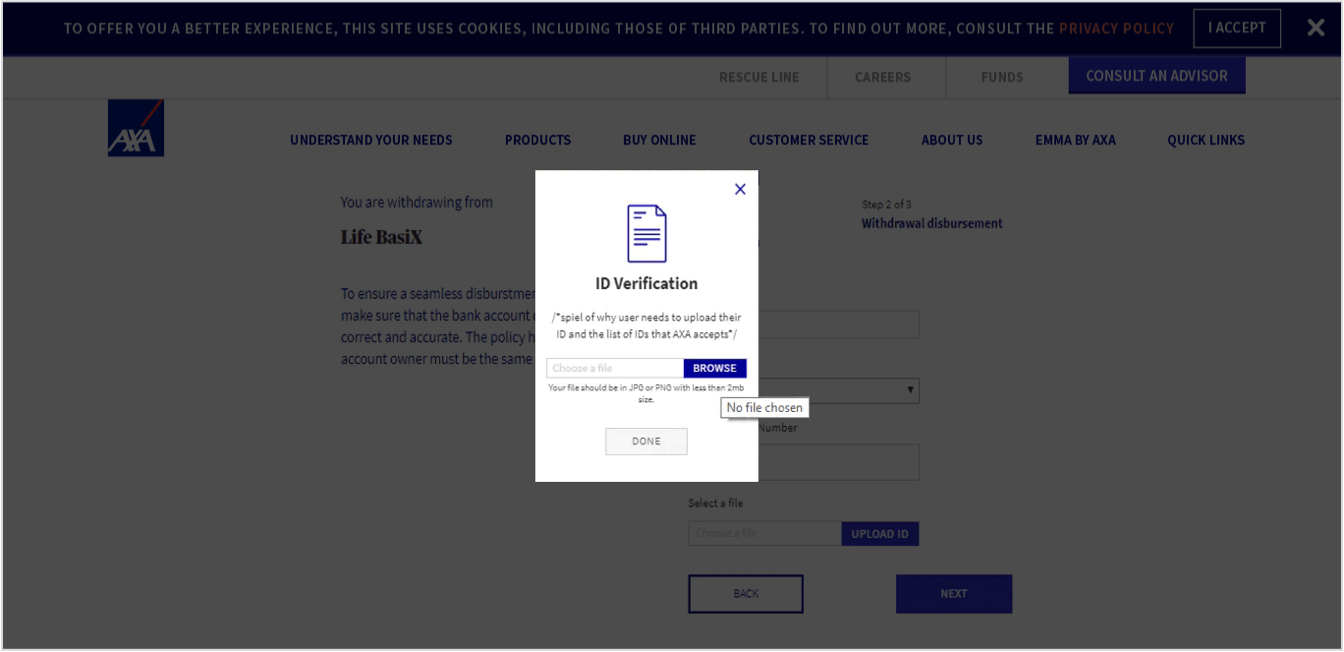

Upload a photo of your ID.

The summary of the fund withdrawal will be shown

Also shown are the declarations and agreement inclusions.

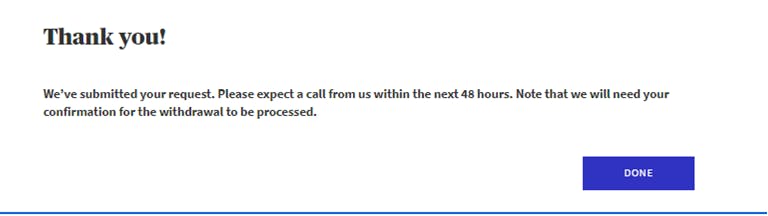

A thank you page will be shown indicating the reference number and if applicable, a customer service representative will call them to confirm the transaction.

1. What is Emma by AXA Fund Withdrawal?

a. Emma by AXA Fund Withdrawal is the newest feature of Emma by AXA web. Now, you can withdraw anytime and anywhere. No need to fill in paper work and visit the branch.

2. Why should I withdraw through Emma by AXA?

a. It’s quick, easy, and convenient. You can perform fund withdrawal transactions anytime and anywhere with only a few clicks!

b. All transactions are secured. With our 2-factor authentication, we make sure that all your transactions are protected.

c. It’s easy to monitor. You can check the status of your withdrawal in real time!

3. Who are eligible to withdraw via Emma by AXA?

a. Customers that will withdraw funds less than 500k

b. Customers with funds in PHP only

c. Customers w/o irrevocable beneficiary

d. Policy that will be withdrawn should NOT be assigned as collateral

e. Customers whose policy is still active and have sufficient funds

f. Excluding Diverxity Policies

4. For partial withdrawal, is there a minimum required withdrawal amount?

a. Yes, minimum required withdrawal amount is USD 400. Withdrawals will not proceed if your partial fund withdrawal amount is less than USD 400 – please note that this may change from time to time depending on the currency exchange rate.

5. For partial withdrawal, is there a minimum maintaining fund balance?

a. Yes, minimum maintaining fund balance is USD 400 too. Partial fund withdrawals will not proceed if the remaining balance from your account will be less than USD 400 – please note that this may change from time to time depending on the currency exchange rate.

6. I can’t withdraw via Emma by AXA. What should I do?

a. For those who are uneligible to withdraw via Emma by AXA (based on item #3), you may still withdraw via our AXA branches or you may contact your financial advisor for withdrawal assistance

7. Can I also withdraw via Emma by AXA app?

a. No, Emma by AXA Withdrawal is only available for Emma by AXA web only

8. Can I withdraw multiple times using Emma by AXA?

a. Yes, you may withdraw multiple times from multiple policies. Please note though that you cannot withdraw from a policy with an existing withdrawal application.

9. What is the process of fund withdrawal via Emma by AXA?

a. Log in to your Emma by AXA account and select the policy where you want to withdraw

b. Select the fund withdrawal button – if you are not eligible to withdraw, you won’t be able to click this button.

c. Select the purpose of the withdrawal

d. Choose if it’s a full or a partial withdrawal

e. Details of the policy will be shown. If it’s a partial withdrawal, you will have to select the units or pesos that you want to withdraw per fund

f. Details of the fund withdrawal amount and surrender charge (if applicable will be shown)

g. Input your bank account details – Emma by AXA withdrawal is only applicable for direct bank transfer also, bank account owner and policy owner should be the same.

h. Upload a photo of your ID

i. Fund withdrawal summary will be shown – with declarations and agreements

j. A thank you page will be shown indicating the reference number and if applicable, a customer service representative will call them to confirm the transaction.

10. I want a check or a cash withdrawal, can I do that via Emma by AXA?

a. For the Emma by AXA fund withdrawal, we are only doing a direct bank transfer. For cash or check withdrawals, you may go through our normal withdrawal process via the AXA branches or ask assistance from your financial advisor.

11. Are you still going to confirm the transaction?

a. For some transactions, yes, a customer representative will call you to confirm the transaction

12. When will I receive the money from the time that I applied?

a. The estimated timeline for the disbursement of the money is around 3-5 days from the time of submission. Assuming that there are no issues with your policy or with your bank and that you are contacted should we need to confirm the transaction with you

13. Is there a cut-off on submission of withdrawals?

a. Submitted withdrawals before 4pm – processing will start on the same working day

b. Submitted withdrawals after 4pm and during weekends / holidays – processing will start the next working day

14. How can I track my transaction?

a. You can go to the “Withdrawal History” to track your transactions. Updates will be placed there real time

15. What are the meaning of the transaction labels in the withdrawal history

a. Submitted – this means that we already received your request

b. In Process – this means that we are already processing and checking your request

c. Approved – your request is already approved and for disbursement

d. Transmitted to the bank – the money is transmitted in your assigned bank account

e. Cancelled - you cancelled your full or partial withdrawal

f. Cancelled (Uncontacted) – you are uncontacted that’s why we cancelled your withdrawal

g. Cancelled (Pending requirements) – there are requirements that needs to be submitted

16. I already submitted my withdrawal request but I want to cancel it, how can I cancel?

a. We are considering all submitted withdrawal applications as final. But should you wish to cancel, submitted withdrawals can only be cancelled by calling our hotline at 85815-292 (AXA) within the day of submission, before 6pm. Otherwise, the withdrawal will continue.

17. I did not receive the one time pin sent, the mobile number indicated is not updated

a. We placed the one time pin authentication that will be sent to your registered mobile number with us for your security. If you want to change your pin, please call our customer care at +63 2 3231-AXA (292). Please note that any change in mobile number will be reflected in our system within 24 hours.

18. I have an irrevocable beneficiary / assigned policy, someone from AXA called me that my withdrawal application via Emma by AXA was cancelled.

a. Policies with irrevocable beneficiary and assigned policies are not eligible to withdraw via Emma by AXA. We may ask for additional requirements for these specific policies. You can still withdraw through our AXA branches or through your financial advisor for assistance.

19. Are there other charges that I have to pay?

a. Aside from possible surrender charges depending on your policy year, non-metrobank bank accounts may also charge applicable bank fees

20. The amount in the withdrawal history is different from the one in my bank account, why is that?

a. The amount displayed in your withdrawal history is based on the valuation date from the time you submitted – this amount may vary depending on the final valuation that usually happens day after submission

21. It says “transmitted to the bank” in my status but the money is still not in my bank

a. Timeline for the whole process is 3 – 5 days. For non-Metrobank accounts, it’s usually plus 2 days from the time that we transmitted it to the assigned bank. It may also be possible that your bank is rejected because of incorrect bank account – if this happens, a customer service representative will call you so you can provide a correct bank account. To avoid this situation, please ensure that the bank account details are correct.

How can I contact customer support for Emma by AXA?

For any concerns regarding your Emma by AXA account, you may contact us via any of the following methods:

Landline:

(+632) 8 5815-AXA(292)

Operating Hours: 8:00 AM - 8:00 PM, Monday - Friday

Mobile:

Globe: +63 917-1709-292

Smart: +63 998-5889-292

Mobile numbers are for calls only.

Email:

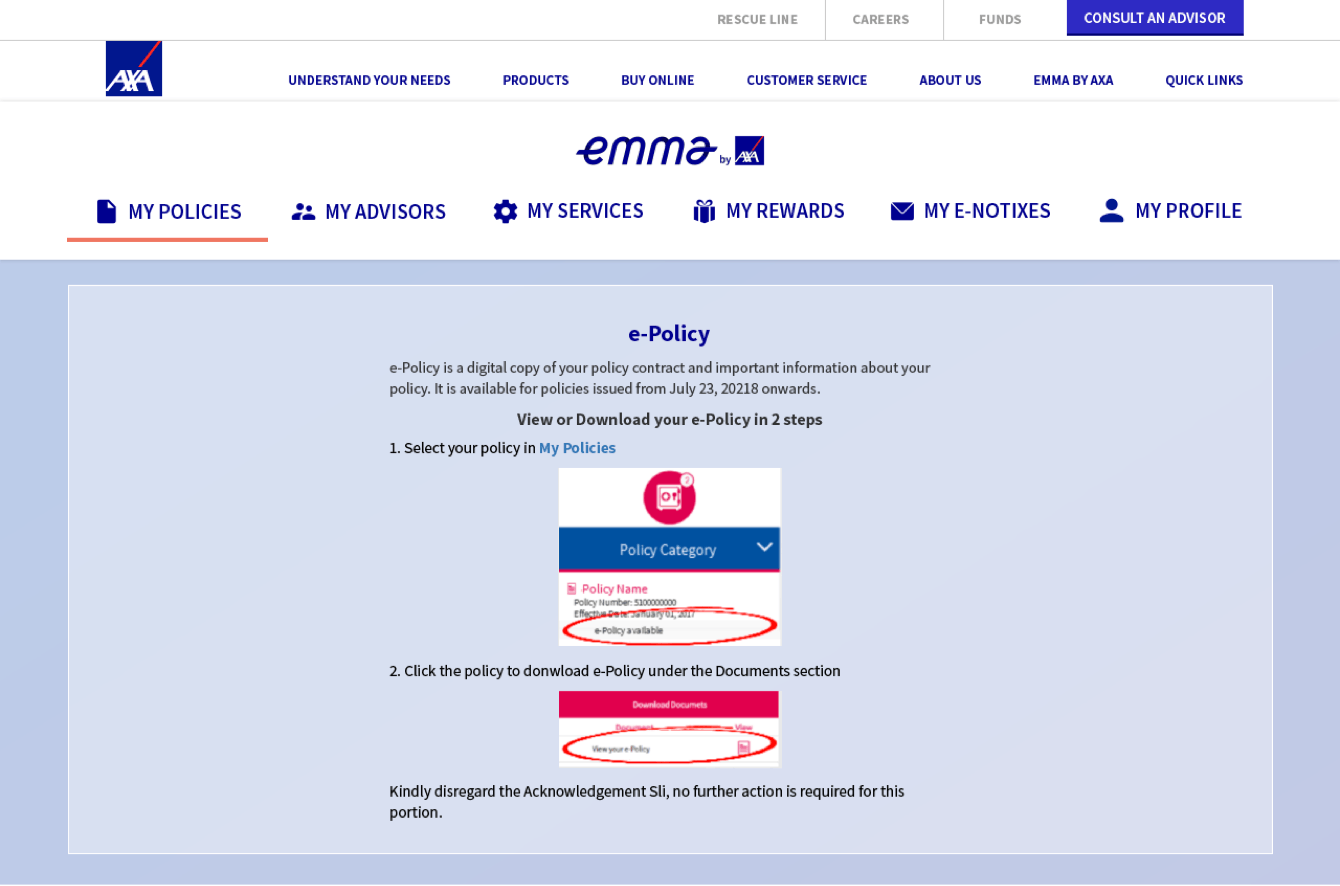

Which of my products have e-Policy?

All AXA products except GHA and policies acquired through AXA ION have e-Policy.

When did e-Policy take effect?

e-Policy is available for all policies issued beginning July 23, 2018

When will my e-Policy be available?

The e-Policy becomes available via Emma by AXA in your Policy Documents within two (2) business days from issuance date.

Where can I download a copy of my e-Policy?

e-Policy is available through Emma by AXA. You may sign up for an account here. After account sign up and policy enrollment, your e-Policy will be available in the Documents section.

You may view, download or share the e-Policy document from there.

Can I still get a hard copy of my policy contract?

Yes, you may get a hard copy of the policy contract upon request. You may contact your Insurance agent or contact us here.

What makes e-Policy better than a hard copy of my policy contract?

With e-Policy, you can get your contract faster. e-Policy is generated and made available through your Emma by AXA account within two (2) working days after policy issuance, while it takes 10-15 business days before the policy owner receives the hard copy of the contract through a courier.

Is my e-Policy considered legal and valid?

Yes. e-Policy is considered legal and valid, and has been approved by the Insurance Commission. The policy owner can save it in his personal storage or print a copy.

When will the cooling-off period take effect?

The 15 days cooling off period will begin on the policy owner's date of receipt of email notification regarding e-Policy availability within Emma by AXA.

Can I request to send my e-Policy through Email?

Unfortunately due to security reasons, we can only send your e-Policy via official channels such as the Emma by AXA Web Login or Mobile App. Upon accessing Emma by AXA, you may download your e-Policy from there.

How can I find my e-Policy in Emma by AXA?

You may view your e-Policy under the Documents section of your Policy details page / screen.

How can I find my e-Policy in the Emma by AXA app?

You may view your "e-Policy Lite" under the policy details or Documents tab.

Can I request for an e-Policy of my old policy contracts?

Currently e-Policy is only available for policies issued from July 23, 2018 onwards for all products except GHA and policies purchased through AXA ION.

Conversion of existing policies issued prior to July 23, 2018 into e-Policy is in the pipeline for future development.

How can I update my beneficiary/ies in Emma by AXA?

Please initially review your existing designated beneficiary/ies. Should you opt to change your revocable beneficiaries, simply update/edit or change the information via your Emma by AXA account.

For irrevocable beneficiary/ies, as they have legal rights over the policy, we regret that we are unable to allow the change via Emma by AXA without their consent. Please contact customer.service@axa.com.ph for further assistance.

What are the requirements for updating my beneficiary/ies?

For revocable beneficiary/ies, you may update the information via your Emma by AXA account.

Kindly follow the designated steps:

1.)Select any of the access points

2.)Click the Services tab > Select ‘Change Beneficiary’

a. View information modal and select ‘Got it’ (Optional: Select ‘Do not ask again')

b. Select ‘Choose Policy’

c. Update Beneficiary List and their share allocation

d. Upload Requirements

e. View Summary

f. Click ‘Next Declarations and Agreement’

g. View Summary

h. Submit

i. Mobile OTP verification step

j. Once verified, please view receipt of request screen

k. You will receive an email receipt of request

3.)Select ‘Beneficiaries’

a. Life policy details page

i. Basic Information

ii. Fund Allocation

iii. Transaction History

iv. Riders

v. Beneficiaries

Display the Beneficiary name:

Full name

When a beneficiary has been selected, display the beneficiary details:

• Name

• Sex

• Nationality

• Date of Birth

• Place of Birth

• Present Address

• Contact Information

• Relationship to the Insured

• Type of Beneficiary

• Beneficiary Designation

• Shares

For irrevocable beneficiary/ies, as they have legal rights over the policy, we regret that we are unable to allow the change via Emma by AXA without their consent. Please contact customer.service@axa.com.ph for further assistance.

Will my update/s in beneficiary/ies be reflected real time when done via Emma by AXA?

Update/s in beneficiary/ies will be reflected within 48 hours. Please expect a confirmation email once the change/s is/are completed.

How often can I update my beneficiary/ies on Emma by AXA?

Provided that the beneficiary/ies is/are revocable, you can change this in Emma by AXA as often as you want.

Can I update my beneficiary/ies via Emma by AXA web and app?

Yes, you can update your revocable beneficiary/ies via Emma by AXA web and app.

Can I change my payment method for my policy/ies in Emma by AXA?

Payment methods for all policies, except single premium policies such as Asset Master, Ambition X may be changed. If you wish to automatically pay your premiums through auto-debit arrangement (ADA), you will need to accomplish and submit your ADA form to AXA Service Center except for PSBank.

If you’re a Metrobank account holder, you may enroll in ADA via the Metrobank mobile app.

If you’re a PSBank account holder, please visit any PSBank Branch.

Can I change my payment mode (e.g., from monthly to quarterly, etc.) in Emma by AXA?

Change in payment mode is based on your plan (i.e., GHA, Life Basix). Please note if the change in payment mode will result to a negative premium variance (shortfall), settlement of the required premium due will be necessary before the change request is carried out.

Why is the cash payment method not allowed for monthly mode of payment?

Monthly mode of payment is only allowed if the method of payment is through Auto-Debit Arrangement (ADA) or credit card. This helps us ensure that your insurance coverage remains active and you continue to be financially protected.

What happens after my request for change in payment method or payment mode has been submitted?

You will receive a notification via email confirming the change in your payment method and/or mode.

Why can't I change the payment mode of my Global Health Access (GHA) policy?

For GHA policies, change in payment mode is allowed within 30 days before the policy anniversary.

Why can’t I change my payment method to cash?

If your current payment mode is monthly, cash as payment method is not allowed. Monthly mode of payment is only allowed if the method of payment is through auto-debit arrangement (ADA) or credit card. This helps us ensure that your insurance coverage remains active and you continue to be financially protected.

For other concerns, please call our

Customer Care Hotline: (02) 8581 5292

Smart (calls only): (+63) 998 5889292

Globe (calls only): (+63) 917 1709292

How do I enroll to auto-pay facilities?

Through AXA’s auto-pay facilities, you can avoid missed premium payments. Automatically settle your premium due through the following:

I. Auto-Debit Arrangement (ADA)

A) For non-Metrobank account holders*:

i. Download the ADA form of your bank here:

• Landbank

• BPI

• BDO

• China Bank

• PNB

ii. Submit a duly accomplished form to your AXA financial partner or to any AXA branch near you. Once the account is successfully enrolled, you will receive confirmation via SMS from AXA. Your next premium due will be deducted from enrolled bank account based on your scheduled billing cycle.

B) For Metrobank account holders*:

• Download the Metrobank mobile app in the App Store or Google Play

• Log in on the Metrobank Mobile App

• Tap Real-time Debit

• Tap + to enroll a new biller

• Tap Accept to authorize automatic debiting from your account

• Search for Philippine AXA Life Insurance Corp and enroll

• Enter your Subscriber Number and Acount Alias, then tap Next

• Select a source account

• Review details, then tap Submit

• Enter your one-time password (OTP)

• Tap OK after the enrollment request has been submitted.

Upload a screenshot of your successful enrollment in the Emma by AXA app.

II. For credit card holders:

Please enroll your credit card through this

link.

Please ensure that you care the owner of the account that you wish to enroll.

What is a premium holiday?

A premium holiday is a product feature of regular-pay variable unit linked (VUL) insurance policies, like Life Basix, aXelerator, MyLifeChoice and Retire Smart, wherein a policy owner may apply for the suspension of his/her payment on basic premium, rider premium, and regular top-up, if applicable, provided that the account value of the policy is sufficient to cover all relevant charges when they fall due.

If you’re planning to activate your premium holiday, we highly recommend that you check your latest account value to ensure that it’s sufficient.

Can my policy lapse due to premium holiday?

If your policy is on premium holiday, your premium payment is charged on your account value to keep the policy active or in-force. However, once the account value is insufficient to cover outstanding charges (cost of insurance, administrative charges, etc.), your policy will lapse or become inactive.

To avoid this, ensure that you have enough account value to cover charges. It’s also best to immediately resume premium payment when you can.

Is my policy eligible for premium holiday?

Premium holiday is applicable to any regular-pay variable unit linked (VUL) policies such as Life Basix, aXelerator, MyLifeChoice, and Retire Smart.

Can I submit my request for premium holiday anytime?

Premium holiday requests should be submitted at least a week before your next premium due date.

To safekeep your investment, we recommend completion of premium payments for at least five (5) years before opting for a premium holiday. You may submit your request through Emma by AXA web and mobile app or through your AXA financial partner.

I submitted my request for premium holiday after my due date (or within the 31-day grace period). What will happen?

The request for premium holiday can still be processed, but will apply on your next premium due date. You will need to settle your last unpaid premium due.

My account value is insufficient to cover the policy charges. Can I still request for a premium holiday?

If your account value is insufficient, your request will not be processed. We recommend paying the unpaid premiums or apply for a lump sum top-up to replenish your account value and avoid having a lapsed policy.

What will happen if my account value is no longer sufficient to cover the policy charges?

Once your account value is no longer sufficient to cover policy charges, your premium holiday will automatically end.

To keep the policy active or in-force, we recommend replenishing your account value by applying for a lump sum top-up or paying the premium due.

How do I resume paying my premium dues?

You may deactivate or end your premium holiday through the Emma by AXA app or web. Simply go to the Services > Premium Holiday and choose which policy/ies you’d like to resume premium payment.

What if my policy is currently assigned as collateral?

Submit the following requirements to the nearest AXA branch:

a. Duly accomplished Variable Life Policy Lump Sum / Regular Top-up and Premium Holiday Application Form

b. Certification from bank (printed in letterhead) with the following details: date, policy number, name of policy owner, name of authorized signatory/ies allowing premium holiday to take effect on policy.

c. Copy of valid ID of the authorized signatory/ies with specimen signature

d. Copy of valid ID of the policy owner with specimen signature

You may also contact your AXA financial partner or call our Customer Hotline at (02) 8581 5292, (+63) 9985889292 (Smart), (+63) 9171709292 (Globe) for further assistance.

How can I check the status of my premium holiday request?

You will receive an email confirmation of your request and an SMS notification on status of your request.

How long does it take to process the request?

It takes 24-48 hours to process your request for premium holiday.

Can I request for premium holiday if my policy has irrevocable beneficiary/ies?

Since irrevocable beneficiary/ies has/have legal rights over the policy, request for premium holiday made through Emma by AXA will not be processed.

Please contact your AXA financial partner or call our Customer Hotline at (02) 8581 5292, (+63) 9985889292 (Smart), (+63) 9171709292 (Globe) for further assistance.

How do I enroll or re-activate Auto-Debit Arrangement?

Enroll/Re-enroll to Auto Debit Arrangement

A. For Non Metrobank Account owners, please ensure that you are the owner of the account being enrolled. Follow the steps below:

I. Download the form here (click the bank name of choice below) to get the official Auto Debit Arrangement form of the bank

• Landbank

• BPI

• BDO

• Chinabank

II. Submit a duly accomplished form to your AXA financial partner or to any AXA branch near you. Once the account is successfully enrolled, you will receive confirmation via SMS from AXA. Your next premium due will be deducted from your enrolled bank account based on your scheduled billing cycle.

B. For Metrobank Account holders*:

• Download the Metrobank mobile app in the App Store or Google Play

• Log in on the Metrobank Mobile App

• Tap Real-time Debit

• Tap + Enroll a new biller

• Tap Accept to authorize automatic debiting from your account

• Search for Philippine AXA Life Insurance Corp and enroll

• Enter your Subscriber Number and Account Alias, then tap Next

• Select a source account

• Review details, then tap Submit

• Enter your one-time password (OTP)

• Tap OK after the enrollment request has been submitted

C. Re-activate Auto-Debit Arrangement

If your previously enrolled auto pay facility is Auto-Debit Arrangement and you did not cancel, all you have to do is call the Customer Hotline to re-activate

Customer Care Hotline: (02) 8581 5292

Smart (calls only): (+63) 9985889292

Globe (calls only): (+63) 9171709292

User's Guide on App

Here are the easy steps in navigating this page so you can maximize all its features and make the most out of your online experience.

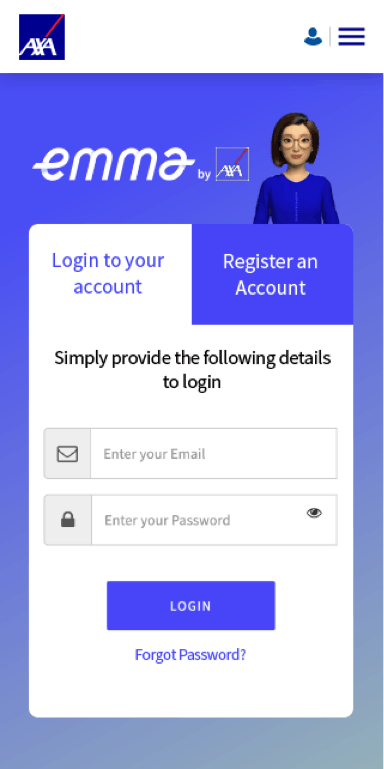

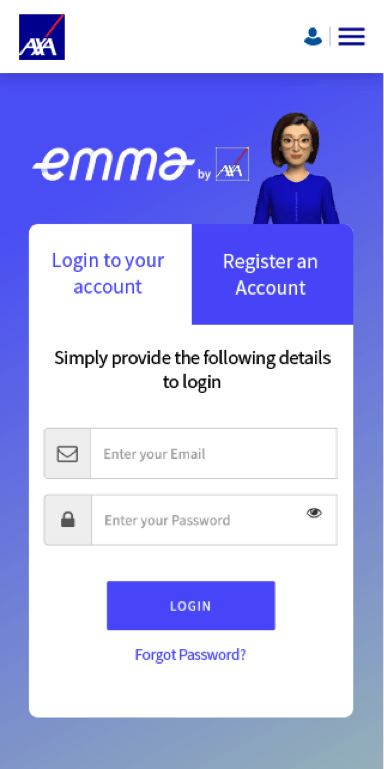

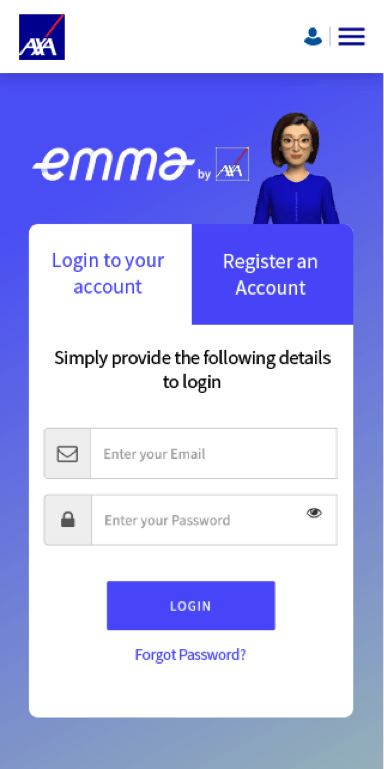

On the Emma by AXA App screen, click login and it will prompt you the log in and registration option.

Just select Register button and it prompt you to enter the email address that you want to register and input your policy number.

After the registration you will need to verify your email address for security reason

Once, you've clicked on the verification link sent from your email, you will need to nominate a password that has

8 or more characters

At least 1 number

At least 1 letter

At least 1 special character ($ @ ! % * # ? &)

CONGRATULATIONS! You are now Registered on Emma by AXA. Simply click Login to continue

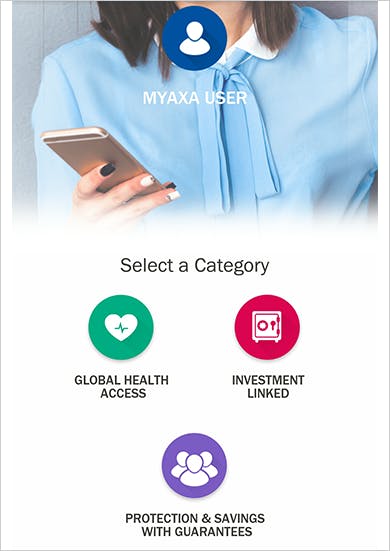

On the Emma by AXA Homepage you can conduct transactions concerning your policy with ease.

Log in to Emma by AXA using your registered email address

If you own multiple policies, choose the policy you want to view.

Investment Linked, Protection and Savings with Guarantees and Global Health

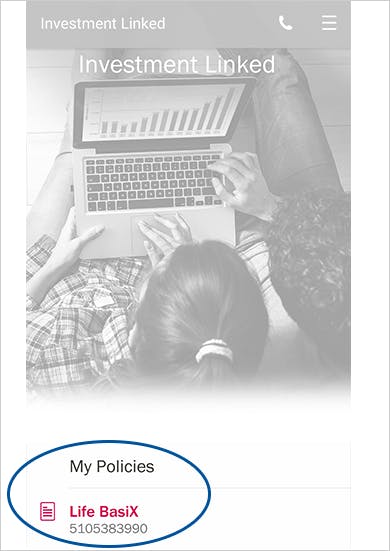

If you select a category e.g. Investment Linked. A page will display the list of your policy/ies available.

For Investment Products, you can view your current account value, fund allocation, fund performance and fund transaction history.

In case your policy has Riders attached to it, you can view the Rider details as well.

Contacting a financial Advisor is now made easy with Emma by AXA

You can directly contact your AXA Financial Partner, simply click My Advisors

You can send a message by clicking the email icon on each of the displayed Advisors

Through your mobile phone you have the option to talk to your advisor by clicking on the call button

Follow these easy steps to reset your password.

To reset your password, simply click on the FORGOT PASSWORD link on Emma by AXA LOGIN Page.

Then enter your registered email and click next.

You will send you a password reset request to your registered email address

You will receive a verification to your provided email to reset your password. Simply Click Verify Request button or the link provided to continue the process.

NOTE:

Please click on the email link once.

After clicking the link, do not reload the page.

Email verification link will expire in 15 minutes.

Congratulations! You may now create a new password with the following conditions:

8 or more characters

At least 1 number

At least 1 letter

At least 1 special character ($ @ ! % * # ? &

How can I contact customer support for Emma by AXA?

For any concerns regarding your Emma by AXA account, you may contact us via any of the following methods:

Landline:

(+632) 8 5815-AXA(292)

Operating Hours: 8:00 AM - 8:00 PM, Monday - Friday

Mobile:

Globe: +63 917-1709-292

Smart: +63 998-5889-292

Mobile numbers are for calls only.

Email:

Which of my products have e-Policy?

All AXA products except GHA and policies acquired through AXA ION have e-Policy.

When did e-Policy take effect?

e-Policy is available for all policies issued beginning July 23, 2018

When will my e-Policy be available?

The e-Policy becomes available via Emma by AXA in your Policy Documents within two (2) business days from issuance date.

Where can I download a copy of my e-Policy?

e-Policy is available through Emma by AXA. You may sign up for an account here. After account sign up and policy enrollment, your e-Policy will be available in the Documents section.

You may view, download or share the e-Policy document from there.

Can I still get a hard copy of my policy contract?

Yes, you may get a hard copy of the policy contract upon request. You may contact your Insurance agent or contact us here.

What makes e-Policy better than a hard copy of my policy contract?

With e-Policy, you can get your contract faster. e-Policy is generated and made available through your Emma by AXA account within two (2) working days after policy issuance, while it takes 10-15 business days before the policy owner receives the hard copy of the contract through a courier.

Is my e-Policy considered legal and valid?

Yes. e-Policy is considered legal and valid, and has been approved by the Insurance Commission. The policy owner can save it in his personal storage or print a copy.

When will the cooling-off period take effect?

The 15 days cooling off period will begin on the policy owner's date of receipt of email notification regarding e-Policy availability within Emma by AXA.

Can I request to send my e-Policy through Email?

Unfortunately due to security reasons, we can only send your e-Policy via official channels such as the Emma by AXA Web Login or Mobile App. Upon accessing Emma by AXA, you may download your e-Policy from there.

How can I find my e-Policy in Emma by AXA?

You may view your e-Policy under the Documents section of your Policy details page / screen.

How can I find my e-Policy in the Emma by AXA app?

You may view your "e-Policy Lite" under the policy details or Documents tab.

Can I request for an e-Policy of my old policy contracts?

Currently e-Policy is only available for policies issued from July 23, 2018 onwards for all products except GHA and policies purchased through AXA ION.

Conversion of existing policies issued prior to July 23, 2018 into e-Policy is in the pipeline for future development.